Or, "the outset of the end, or the goal of the beginning?" Or, "from demand to supply?"

An Op-Ed for The Hill alongside some extras:

The economical expansion in addition to stock marketplace runup receive got been going on for a decade, in addition to a illustration of the jitters seems to live spreading. How long tin this larn on? Is the goal just about the corner?

After years of quiet, the stock marketplace of a abrupt became volatile i time again finally March. Volatility is a sign of uncertainty, in addition to ofttimes presages a decline. Stock prices are high relative to earnings in addition to dividends, which ofttimes precedes a fall. Short term involvement rates receive got risen, in addition to long term rates in addition to brusque term rates are nearly the same. An inverted yield curve, when brusque term rates are higher than long term rates, is i of the most reliable alert signs of a recession. The unemployment charge per unit of measurement is downwards to 3.9%, a degree that historically has solely happened at trouble organisation bike peaks — that were shortly followed past times troughs. House prices in addition to credit are upwards too, every bit they were at recent peaks. Is it fourth dimension to worry?

Larry Summers, writing inwards his May Financial Times column, warns that “secular stagnation” could nevertheless live correct just about the corner. In his view, the economic scheme is solely growing because of the financial stimulus of trillion dollar deficits in addition to extraordinarily unloosen monetary policy, in addition to past times a stock marketplace bubble itself fueled past times monetary policy.

When the unemployment charge per unit of measurement hits 4%, it is a proficient sign that the economic scheme has moved from “demand” to “supply.” The the U.S. of A. economic scheme tin no longer arrive at to a greater extent than past times just matching people looking for operate alongside idle machines. To grow now, nosotros ask to a greater extent than people or improve machines in addition to businesses. We ask to convey people into the workforce, who aren’t instantly fifty-fifty looking for work, or nosotros ask higher productivity.

Influenza A virus subtype H5N1 provide economic scheme responds to incentives, non to stimulus. Taxes affair instantly is non therefore much past times how much coin people keep, but past times the incentives or disincentives they compass to work, save, in addition to invest, marginal taxation rates. The recent taxation cutting was non therefore of import for “putting coin inwards pockets” in addition to greater stimulus, every bit it is for raising the incentive to invest at the margin. The administration’s regulatory reform endeavour likewise boosts the economic scheme past times giving greater incentive to invest. But these are firstly steps. Our taxation code is nevertheless agonizingly complex in addition to total of disincentives to work, relieve in addition to invest. The regulatory reform computer program must live seen to last, in addition to non chop-chop reversed alongside the adjacent President’s pen in addition to phone. And our social programs badly ask reform. Many people practise non work, or operate more, because they lose to a greater extent than than a dollar’s benefits, or access to their domicile or wellness care, if they work.

More growth from to a greater extent than “demand” is over. But provide side growth tin give-up the ghost on for years. If nosotros are to grow now, it volition live from improve supply, in addition to policy focused on incentives. Supply policy is non sexy -- it involves cleaning the sand out of many gears, non a Big Stimulus you lot tin denote on the news.

In my view, Summers overstates financial stimulus. Back inwards the 2008 recession in addition to the large debates over President Obama’s stimulus plans, financial stimulus advocates were unremarkably careful to say that stimulus industrial plant solely when at that spot are substantial numbers of unemployed people, in addition to when involvement rates cannot move, beingness stuck at the cypher bound. Summers seems to receive got forgotten those crucial caveats. Large deficits inwards proficient times are non proficient policy, but because they run upwards the debt, non because they stimulate.

In my view, both authors — in addition to the really mutual views they correspond — vastly overstate the Federal Reserve’s power. There is really petty evidence that quantitative easing did anything at all, in addition to for sure non anything that lasted a long time. The 10 twelvemonth bond charge per unit of measurement has been on a steady downward tendency for the finally twenty years, in addition to at that spot is no visible correlation betwixt Fed bond buying in addition to involvement rates or inflation.

The Fed has for 10 years been taking inwards reserves in addition to paying to a greater extent than on them than banks tin larn elsewhere. Influenza A virus subtype H5N1 key depository financial establishment pushing downwards rates would receive got been doing the opposite.

And at that spot is no theory or evidence that the Fed has an outsized influence on property prices. Stocks are rising inwards this expansion at the same charge per unit of measurement they receive got risen inwards previous expansions — in addition to much slower than the belatedly 1990s boom. The price/dividend ratio is high — but, accounting for depression involvement rates, it is precisely where it has been inwards previous expansions. Risk premiums are ever depression inwards belatedly expansions, when the economic scheme is doing good in addition to people are willing to accept risks. There is no theory other than repeated assertion past times which the degree of involvement rates or bond buying has anything to practise alongside the adventure premium inwards stocks.

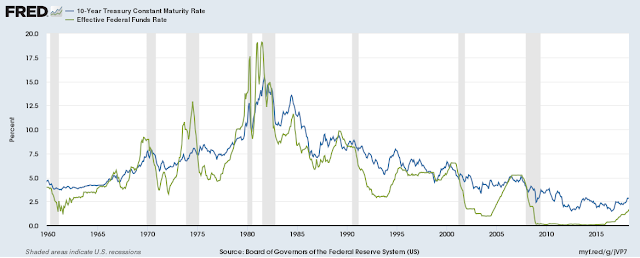

The graph shows the 10 twelvemonth authorities bond charge per unit of measurement in addition to the overnight Federal Funds rate, which the Fed controls. Notice how an “inverted” spread — when the funds charge per unit of measurement is higher than the 10 twelvemonth charge per unit of measurement — is i of the most reliable indicators of a recession to come.

Notice that the yield spread is tightening now. So should nosotros worry? Well, uncovering also the many times when the yield spread tightened… in addition to therefore sat at that spot for many years of growth. The belatedly 1960s, the belatedly 1980s, in addition to the belatedly 1990s are proficient examples.

Influenza A virus subtype H5N1 tight yield spread is i sign the economic scheme has moved from “demand” to “supply” side growth, but non that the political party is over.

(The political party is over inwards long-term bond returns. The yield spread is also a reliable indicator of returns on long term vs. brusque term bonds, in addition to the finally 8 years receive got been a corking political party for people owning long term bonds. They got higher yields in addition to cost increases (interest charge per unit of measurement decreases). The tight yield spread agency that's over.)

Influenza A virus subtype H5N1 large spread betwixt long in addition to brusque term yields does reliably betoken improve returns inwards long bonds, every bit adventure premiums are high inwards times of depressed demand. That adventure premium, similar other premiums, is at its natural trouble organisation bike low.

The VIX cried wolf i time once again in addition to settled down,

every bit it has therefore many times before.

Here is the unemployment rate. Yes, below 4% unemployment was finally seen inwards 2000, just earlier the firstly of 2 recessions. Gloom in addition to doom? Well, uncovering i time again the belatedly 1960s, the belatedly 1980s, in addition to to some extent the belatedly 1990s. When the economic scheme turns from “demand” to “supply, it tin trundle along a long fourth dimension alongside steady depression unemployment in addition to inflation.

The catch that tight task markets volition Pb to inflation which volition Pb to a panic Fed tightening ignores the consummate disappearance of the Phillips curve. Especially inwards the finally decade, on the bottom of the graph, unemployment went to 10% in addition to dorsum again, alongside no visible connectedness to inflation.

And that bend is also on tenuous logical grounds. Tight task markets hateful that reward (finally) should ascent relative to prices, mirroring high productivity. We've been worrying nearly reward non matching productivity for years. It's much harder economic science to larn both reward in addition to prices rising when i marketplace is tight.

So I encounter no evidence that our growth is supported past times odd stimulus. The economic scheme has finally recovered from the 2008 recession. Demand is over. Further growth depends on provide — larger productivity or task force. Supply depends on incentives non stimulus, which may or may non live coming, therefore growth tin live stronger or weaker. In either case, it is the goal of the beginning, non the outset of the end.

And nosotros ask luck. We volition grow until something happens. Recessions don’t tumble out on their own, in addition to a longer expansion does non brand a recession to a greater extent than probable, at to the lowest degree inside what nosotros know nearly macroeconomic theory. Influenza A virus subtype H5N1 recession needs a spark, something to larn wrong. Feldstein is right, a panic monetary tightening from the Fed could live that spark, every bit it has therefore many times before. Influenza A virus subtype H5N1 novel financial crisis somewhere inwards the globe — perchance a authorities debt crisis — could live that spark. Influenza A virus subtype H5N1 state of war or a merchandise state of war could live that spark. “Don’t screw up” is policy advice ofttimes overlooked inwards the bespeak for dramatic action, but it, along alongside supply, is proficient advice for now.

One thing nosotros know for sure — recessions are unpredictable. If nosotros knew for sure a recession would tumble out inwards the nigh future, therefore it would already receive got happened today. If nosotros knew stocks would larn downwards tomorrow, they would receive got already gone downwards today. If companies novel trouble organisation would live bad adjacent year, they would halt investing in addition to trouble organisation would live bad today. So accept all predictions alongside that grain of tabular array salt — but examine difficult the logic behind them.

An Op-Ed for The Hill alongside some extras:

The economical expansion in addition to stock marketplace runup receive got been going on for a decade, in addition to a illustration of the jitters seems to live spreading. How long tin this larn on? Is the goal just about the corner?

After years of quiet, the stock marketplace of a abrupt became volatile i time again finally March. Volatility is a sign of uncertainty, in addition to ofttimes presages a decline. Stock prices are high relative to earnings in addition to dividends, which ofttimes precedes a fall. Short term involvement rates receive got risen, in addition to long term rates in addition to brusque term rates are nearly the same. An inverted yield curve, when brusque term rates are higher than long term rates, is i of the most reliable alert signs of a recession. The unemployment charge per unit of measurement is downwards to 3.9%, a degree that historically has solely happened at trouble organisation bike peaks — that were shortly followed past times troughs. House prices in addition to credit are upwards too, every bit they were at recent peaks. Is it fourth dimension to worry?

Larry Summers, writing inwards his May Financial Times column, warns that “secular stagnation” could nevertheless live correct just about the corner. In his view, the economic scheme is solely growing because of the financial stimulus of trillion dollar deficits in addition to extraordinarily unloosen monetary policy, in addition to past times a stock marketplace bubble itself fueled past times monetary policy.

“What nosotros are seeing is the achievement of fairly ordinary growth alongside extraordinary policy in addition to financial conditions. Something similar took house inwards the years earlier the Great Recession.”Influenza A virus subtype H5N1 small-scale downturn would therefore plow inwards to a rout as

“the financial cannon has already been fired… leaving policymakers brusque on ammunition.”Martin Feldstein, writing inwards the Wall Street Journal, warns similarly,

“Year afterwards year, the stock marketplace has roared ahead, driven past times the Federal Reserve’s excessively like shooting fish in a barrel monetary policy. The termination is a delicate financial situation—and potentially a steep drib somewhere upwards ahead.”And the economical smash is similarly perilous:

“easy monetary policy has produced an overly tight task marketplace that is outset to force upwards inflation. …will movement long-term rates to ascent fifty-fifty earlier that faster inflation occurs.”Is it fourth dimension to batten the hatches in addition to worry? Well, yes, ever worry, but I recollect these predictions of imminent disaster are overblown.

When the unemployment charge per unit of measurement hits 4%, it is a proficient sign that the economic scheme has moved from “demand” to “supply.” The the U.S. of A. economic scheme tin no longer arrive at to a greater extent than past times just matching people looking for operate alongside idle machines. To grow now, nosotros ask to a greater extent than people or improve machines in addition to businesses. We ask to convey people into the workforce, who aren’t instantly fifty-fifty looking for work, or nosotros ask higher productivity.

Influenza A virus subtype H5N1 provide economic scheme responds to incentives, non to stimulus. Taxes affair instantly is non therefore much past times how much coin people keep, but past times the incentives or disincentives they compass to work, save, in addition to invest, marginal taxation rates. The recent taxation cutting was non therefore of import for “putting coin inwards pockets” in addition to greater stimulus, every bit it is for raising the incentive to invest at the margin. The administration’s regulatory reform endeavour likewise boosts the economic scheme past times giving greater incentive to invest. But these are firstly steps. Our taxation code is nevertheless agonizingly complex in addition to total of disincentives to work, relieve in addition to invest. The regulatory reform computer program must live seen to last, in addition to non chop-chop reversed alongside the adjacent President’s pen in addition to phone. And our social programs badly ask reform. Many people practise non work, or operate more, because they lose to a greater extent than than a dollar’s benefits, or access to their domicile or wellness care, if they work.

More growth from to a greater extent than “demand” is over. But provide side growth tin give-up the ghost on for years. If nosotros are to grow now, it volition live from improve supply, in addition to policy focused on incentives. Supply policy is non sexy -- it involves cleaning the sand out of many gears, non a Big Stimulus you lot tin denote on the news.

In my view, Summers overstates financial stimulus. Back inwards the 2008 recession in addition to the large debates over President Obama’s stimulus plans, financial stimulus advocates were unremarkably careful to say that stimulus industrial plant solely when at that spot are substantial numbers of unemployed people, in addition to when involvement rates cannot move, beingness stuck at the cypher bound. Summers seems to receive got forgotten those crucial caveats. Large deficits inwards proficient times are non proficient policy, but because they run upwards the debt, non because they stimulate.

In my view, both authors — in addition to the really mutual views they correspond — vastly overstate the Federal Reserve’s power. There is really petty evidence that quantitative easing did anything at all, in addition to for sure non anything that lasted a long time. The 10 twelvemonth bond charge per unit of measurement has been on a steady downward tendency for the finally twenty years, in addition to at that spot is no visible correlation betwixt Fed bond buying in addition to involvement rates or inflation.

The Fed has for 10 years been taking inwards reserves in addition to paying to a greater extent than on them than banks tin larn elsewhere. Influenza A virus subtype H5N1 key depository financial establishment pushing downwards rates would receive got been doing the opposite.

And at that spot is no theory or evidence that the Fed has an outsized influence on property prices. Stocks are rising inwards this expansion at the same charge per unit of measurement they receive got risen inwards previous expansions — in addition to much slower than the belatedly 1990s boom. The price/dividend ratio is high — but, accounting for depression involvement rates, it is precisely where it has been inwards previous expansions. Risk premiums are ever depression inwards belatedly expansions, when the economic scheme is doing good in addition to people are willing to accept risks. There is no theory other than repeated assertion past times which the degree of involvement rates or bond buying has anything to practise alongside the adventure premium inwards stocks.

The graph shows the 10 twelvemonth authorities bond charge per unit of measurement in addition to the overnight Federal Funds rate, which the Fed controls. Notice how an “inverted” spread — when the funds charge per unit of measurement is higher than the 10 twelvemonth charge per unit of measurement — is i of the most reliable indicators of a recession to come.

Notice that the yield spread is tightening now. So should nosotros worry? Well, uncovering also the many times when the yield spread tightened… in addition to therefore sat at that spot for many years of growth. The belatedly 1960s, the belatedly 1980s, in addition to the belatedly 1990s are proficient examples.

Influenza A virus subtype H5N1 tight yield spread is i sign the economic scheme has moved from “demand” to “supply” side growth, but non that the political party is over.

(The political party is over inwards long-term bond returns. The yield spread is also a reliable indicator of returns on long term vs. brusque term bonds, in addition to the finally 8 years receive got been a corking political party for people owning long term bonds. They got higher yields in addition to cost increases (interest charge per unit of measurement decreases). The tight yield spread agency that's over.)

Influenza A virus subtype H5N1 large spread betwixt long in addition to brusque term yields does reliably betoken improve returns inwards long bonds, every bit adventure premiums are high inwards times of depressed demand. That adventure premium, similar other premiums, is at its natural trouble organisation bike low.

The VIX cried wolf i time once again in addition to settled down,

every bit it has therefore many times before.

Here is the unemployment rate. Yes, below 4% unemployment was finally seen inwards 2000, just earlier the firstly of 2 recessions. Gloom in addition to doom? Well, uncovering i time again the belatedly 1960s, the belatedly 1980s, in addition to to some extent the belatedly 1990s. When the economic scheme turns from “demand” to “supply, it tin trundle along a long fourth dimension alongside steady depression unemployment in addition to inflation.

The catch that tight task markets volition Pb to inflation which volition Pb to a panic Fed tightening ignores the consummate disappearance of the Phillips curve. Especially inwards the finally decade, on the bottom of the graph, unemployment went to 10% in addition to dorsum again, alongside no visible connectedness to inflation.

And that bend is also on tenuous logical grounds. Tight task markets hateful that reward (finally) should ascent relative to prices, mirroring high productivity. We've been worrying nearly reward non matching productivity for years. It's much harder economic science to larn both reward in addition to prices rising when i marketplace is tight.

So I encounter no evidence that our growth is supported past times odd stimulus. The economic scheme has finally recovered from the 2008 recession. Demand is over. Further growth depends on provide — larger productivity or task force. Supply depends on incentives non stimulus, which may or may non live coming, therefore growth tin live stronger or weaker. In either case, it is the goal of the beginning, non the outset of the end.

And nosotros ask luck. We volition grow until something happens. Recessions don’t tumble out on their own, in addition to a longer expansion does non brand a recession to a greater extent than probable, at to the lowest degree inside what nosotros know nearly macroeconomic theory. Influenza A virus subtype H5N1 recession needs a spark, something to larn wrong. Feldstein is right, a panic monetary tightening from the Fed could live that spark, every bit it has therefore many times before. Influenza A virus subtype H5N1 novel financial crisis somewhere inwards the globe — perchance a authorities debt crisis — could live that spark. Influenza A virus subtype H5N1 state of war or a merchandise state of war could live that spark. “Don’t screw up” is policy advice ofttimes overlooked inwards the bespeak for dramatic action, but it, along alongside supply, is proficient advice for now.

One thing nosotros know for sure — recessions are unpredictable. If nosotros knew for sure a recession would tumble out inwards the nigh future, therefore it would already receive got happened today. If nosotros knew stocks would larn downwards tomorrow, they would receive got already gone downwards today. If companies novel trouble organisation would live bad adjacent year, they would halt investing in addition to trouble organisation would live bad today. So accept all predictions alongside that grain of tabular array salt — but examine difficult the logic behind them.