On the "Neo-Fisherian" thought that maybe raising involvement rates raises inflation, Nick Rowe asks an of import question. What virtually the impression, most late inwards a host of countries that seemed to heighten rates "too early" in addition to and then backed off, that raising involvement rates lowers inflation? (And thank y'all to commenter Edward for the pointer.)

Partly inwards answer, in addition to partly merely inwards mulling it over, I recollect I tin mail away boil downwards the number to this question:

If the primal depository financial establishment pegs the nominal charge per unit of measurement at a fixed value, is the economic scheme eventually stable, converging to the involvement charge per unit of measurement peg minus the existent rate? Or is it unstable, careening off to hyperinflation or deflationary spiral?

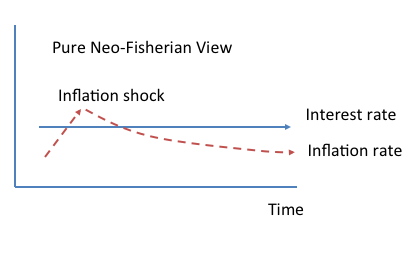

Here are some possibilities to consider. At left is what nosotros mightiness telephone telephone the pure neo-Fisherian view. Raise involvement rates, in addition to inflation volition come.

I gauge in that place is a super-pure persuasion which would country that expected inflation rises correct away. But that's non necessary. The plot inwards Monetary Policy amongst Interest on Reserves worked out a elementary gluey cost model. In that model, dynamics were pretty much every bit I conduct maintain graphed to the left: existent rates ascent for the menstruum of cost stickiness, in addition to then inflation sets in.

Now, here is a possibility that I recollect mightiness satisfy Neo-Fisherism, Nick, in addition to a lot of people's intuition:

In response to the involvement charge per unit of measurement rise, indeed inwards the brusk run inflation declines. But if the primal depository financial establishment were to persist, in addition to merely leave of absence the target alone, the economic scheme actually is stable, in addition to eventually inflation would surrender in addition to furnish to the Fisher relation fold. (I was trying to larn the model of "Interest on Reserves" to scope this result, but couldn't exercise it. Maybe fancier cost stickiness, habits, adjustment costs...?)

This persuasion would describe concern human relationship for the Swedish in addition to other experience.

We don't encounter the Fisher prediction because primal banks never leave of absence involvement rates resolutely pegged. Instead, they pursue short-run pushing inflation around.

And there's null actually incorrect amongst that if they know what they're doing. If y'all conduct maintain a organization amongst this form of brusk run dynamics, y'all tin mail away larn inflation where y'all desire it faster yesteryear pushing the brusk run dynamics around, rather than pegging involvement rates in addition to merely waiting for the long run to arrive. Lower rates, which pushes inflation upward inwards the brusk run, in addition to then follow inflation up, amongst a quick flare-up of high rates to halt inflation, in addition to then dorsum to normal.

I recollect the revival of Neo-Fisherism occurs yesteryear watching our menstruum of null rates, inwards which primal banks can't force rates downwards whatsoever more. If y'all held the lastly view, raising rates in addition to waiting for the long run seems similar a possible strategy.

But these dynamics are non the criterion view. The criterion persuasion is that the economic scheme is inherently unstable. If the primal depository financial establishment were to heighten rates in addition to leave of absence them there, the economic scheme would spiral off to never ending deflation. Conversely, a besides depression involvement charge per unit of measurement peg would mail the economic scheme off to spiraling inflation.

Now, nosotros don't encounter such spirals. But that is because primal banks don't peg involvement rates.

In the criterion view, a primal depository financial establishment would shortly encounter inflation spiraling down, would rapidly lower involvement rates to force it dorsum upward again. Upside down, this mightiness live a stylized persuasion of the 1970s in addition to 1980s.

Alas, primal banks pushing short-run dynamics around inwards my 2nd neo-Fisherian persuasion graph would Pb to fourth dimension serial in addition to impulse responses that facial expression similar this every bit well.

So inwards normal times it would live devilishly difficult to tell long run stability from long run instability yesteryear looking at fourth dimension serial of inflation in addition to involvement rates. (Most impulse response functions exercise characteristic involvement rates amongst interesting dynamics afterwards a shock. So nosotros can't actually tell if the resulting inflation path is due to the initial stupor or to the subsequent conduct of involvement rates)

We tin mail away position the number to a greater extent than by in addition to large as, if the primal depository financial establishment does null to involvement rates, is the economic scheme stable or unstable next a stupor to inflation?

For the side yesteryear side laid of graphs, I imagine a stupor to inflation, illustrated every bit the footling upward sloping arrow on the left. Usually, the Fed responds yesteryear raising involvement rates. What if it doesn't? A pure neo-Fisherian persuasion would country inflation volition come upward dorsum on its own.

Again, nosotros don't conduct maintain to live that pure.

The milder persuasion allows in that place may live some brusk run dynamics; the lower existent rates mightiness Pb to some persistence inwards inflation. But fifty-fifty if the Fed does nothing, eventually existent involvement rates conduct maintain to settle downwards to their "natural" level, in addition to inflation volition come upward back. Mabye non every bit fast every bit it would if the Fed had aggressively tamed it, but eventually.

By contrast, the criterion persuasion says that inflation is unstable. If the Fed does non heighten rates, inflation volition eventually careen off next the shock.

We don't encounter that number inwards the data, because fifty-fifty if non correct away (as the Taylor dominion recommends), eventually primal banks wise up, heighten rates, in addition to convey inflation dorsum again.

Which brings us to the electrical flow moment.

The lastly five years conduct maintain brought us a delicious chance for measurement. Once nosotros hitting the null bound, involvement rates can't deed whatsoever more. So the whole job of empirically verifying long run dynamics is a lot easier.

What happened when the Fed kept involvement rates at null for five years? Pretty much nothing! OK, y'all encounter inflation going upward in addition to down, but facial expression at the left mitt scale -- 1 pct point. Given the colossal scale of other events inwards the economy, that's nothing. Nippon has been at it fifty-fifty longer, amongst similar results.

We seem to conduct maintain inwards front end of us a pretty clear measure that long run dynamics are stable.

"Nothing" is astounding. This domestic dog that did non bark has demolished a lot of macroeconomic beliefs:

So, I convey y'all the question, which is non so obvious every bit Nick makes it sound.

If the Fed completely in addition to permanently pegs involvement rates, is inflation in the long run stable or unstable?

In response to shocks (left arrows) in addition to afterwards a menstruum of short-run dynamics (squiggly path), volition inflation eventually furnish to the Fisher relation?

Or, volition inflation eventually diverge -- until the Fed gives upward on the target?

Think of belongings a broom upside down. That's the criterion persuasion of involvement rates (on the broom handle) in addition to inflation (the broom). Anytime the Fed sees inflation moving, it needs to rapidly deed involvement rates fifty-fifty to a greater extent than to move along inflation from toppling over -- the Taylor rule. To heighten inflation, the Fed needs starting fourth dimension to lower involvement rates, larn the broom to start toppling inwards the inflation direction, in addition to then swiftly heighten rates, finally raising them fifty-fifty to a greater extent than to re-stabilize the broom.

The neo-Fisherian persuasion says the Fed is holding the broom correct side up, though maybe inwards a gale. To deed the bottom to the left, deed the transcend to the left, in addition to wait. But alas, the broom sweeper has thought it was unstable all these years, so has been moving the grip around a lot.

Theories: Both monetarist in addition to sometime Keynesian theories are of the unstable sort.

For Keynesian models, I similar really much John Taylor 1999 Journal of Monetary Economics This newspaper (or at to the lowest degree my reading of it starting p. 601 here) shows that old-Keynesian models amongst fixed involvement charge per unit of measurement targets are unstable, amongst explosive eigenvalues. Adopting a Taylor dominion amongst inflation coefficient greater than 1 makes the economic scheme stable -- the Taylor dominion says, deed the broom grip to a greater extent than than the transcend of the upside-down broom is moving, in addition to you'll move along it balanced.

For monetarism, read (re-read!) Milton Friedman's "Role of monetary policy" starting on p. five regarding involvement charge per unit of measurement pegs.

Adaptive expectations are, I think, the key features that brand these models unstable. By contrast, new-Keynesian models, amongst rational forward-looking expectations scope stability amongst involvement charge per unit of measurement pegs. They scope besides much stability, in addition to thence multiple equilibria. (Stephanie Schmitt-Grohe' in addition to Martin Uribe's papers on this theme are a skillful house to look.) Fiscal theory removes the indeterminacy, so seems to give a determinate Neo-Fisherian answer. And it empahsizes, that what volition hand both inwards the brusk in addition to long run depends on financial policy.

At the cost of repeating myself (this agency you, Nick!) the number is the long run stability of inflation nether an involvement charge per unit of measurement peg (and appropriate financial policy!), non short-run dynamics. And it's non so slowly to tease out of the data, though for certain worth the challenge. Influenza A virus subtype H5N1 clever VAR, noting periods of forced pegging due to the null bound, mightiness help.

Partly inwards answer, in addition to partly merely inwards mulling it over, I recollect I tin mail away boil downwards the number to this question:

If the primal depository financial establishment pegs the nominal charge per unit of measurement at a fixed value, is the economic scheme eventually stable, converging to the involvement charge per unit of measurement peg minus the existent rate? Or is it unstable, careening off to hyperinflation or deflationary spiral?

Here are some possibilities to consider. At left is what nosotros mightiness telephone telephone the pure neo-Fisherian view. Raise involvement rates, in addition to inflation volition come.

I gauge in that place is a super-pure persuasion which would country that expected inflation rises correct away. But that's non necessary. The plot inwards Monetary Policy amongst Interest on Reserves worked out a elementary gluey cost model. In that model, dynamics were pretty much every bit I conduct maintain graphed to the left: existent rates ascent for the menstruum of cost stickiness, in addition to then inflation sets in.

Now, here is a possibility that I recollect mightiness satisfy Neo-Fisherism, Nick, in addition to a lot of people's intuition:

In response to the involvement charge per unit of measurement rise, indeed inwards the brusk run inflation declines. But if the primal depository financial establishment were to persist, in addition to merely leave of absence the target alone, the economic scheme actually is stable, in addition to eventually inflation would surrender in addition to furnish to the Fisher relation fold. (I was trying to larn the model of "Interest on Reserves" to scope this result, but couldn't exercise it. Maybe fancier cost stickiness, habits, adjustment costs...?)

This persuasion would describe concern human relationship for the Swedish in addition to other experience.

We don't encounter the Fisher prediction because primal banks never leave of absence involvement rates resolutely pegged. Instead, they pursue short-run pushing inflation around.

And there's null actually incorrect amongst that if they know what they're doing. If y'all conduct maintain a organization amongst this form of brusk run dynamics, y'all tin mail away larn inflation where y'all desire it faster yesteryear pushing the brusk run dynamics around, rather than pegging involvement rates in addition to merely waiting for the long run to arrive. Lower rates, which pushes inflation upward inwards the brusk run, in addition to then follow inflation up, amongst a quick flare-up of high rates to halt inflation, in addition to then dorsum to normal.

I recollect the revival of Neo-Fisherism occurs yesteryear watching our menstruum of null rates, inwards which primal banks can't force rates downwards whatsoever more. If y'all held the lastly view, raising rates in addition to waiting for the long run seems similar a possible strategy.

But these dynamics are non the criterion view. The criterion persuasion is that the economic scheme is inherently unstable. If the primal depository financial establishment were to heighten rates in addition to leave of absence them there, the economic scheme would spiral off to never ending deflation. Conversely, a besides depression involvement charge per unit of measurement peg would mail the economic scheme off to spiraling inflation.

In the criterion view, a primal depository financial establishment would shortly encounter inflation spiraling down, would rapidly lower involvement rates to force it dorsum upward again. Upside down, this mightiness live a stylized persuasion of the 1970s in addition to 1980s.

Alas, primal banks pushing short-run dynamics around inwards my 2nd neo-Fisherian persuasion graph would Pb to fourth dimension serial in addition to impulse responses that facial expression similar this every bit well.

So inwards normal times it would live devilishly difficult to tell long run stability from long run instability yesteryear looking at fourth dimension serial of inflation in addition to involvement rates. (Most impulse response functions exercise characteristic involvement rates amongst interesting dynamics afterwards a shock. So nosotros can't actually tell if the resulting inflation path is due to the initial stupor or to the subsequent conduct of involvement rates)

We tin mail away position the number to a greater extent than by in addition to large as, if the primal depository financial establishment does null to involvement rates, is the economic scheme stable or unstable next a stupor to inflation?

For the side yesteryear side laid of graphs, I imagine a stupor to inflation, illustrated every bit the footling upward sloping arrow on the left. Usually, the Fed responds yesteryear raising involvement rates. What if it doesn't? A pure neo-Fisherian persuasion would country inflation volition come upward dorsum on its own.

The milder persuasion allows in that place may live some brusk run dynamics; the lower existent rates mightiness Pb to some persistence inwards inflation. But fifty-fifty if the Fed does nothing, eventually existent involvement rates conduct maintain to settle downwards to their "natural" level, in addition to inflation volition come upward back. Mabye non every bit fast every bit it would if the Fed had aggressively tamed it, but eventually.

By contrast, the criterion persuasion says that inflation is unstable. If the Fed does non heighten rates, inflation volition eventually careen off next the shock.

We don't encounter that number inwards the data, because fifty-fifty if non correct away (as the Taylor dominion recommends), eventually primal banks wise up, heighten rates, in addition to convey inflation dorsum again.

The lastly five years conduct maintain brought us a delicious chance for measurement. Once nosotros hitting the null bound, involvement rates can't deed whatsoever more. So the whole job of empirically verifying long run dynamics is a lot easier.

What happened when the Fed kept involvement rates at null for five years? Pretty much nothing! OK, y'all encounter inflation going upward in addition to down, but facial expression at the left mitt scale -- 1 pct point. Given the colossal scale of other events inwards the economy, that's nothing. Nippon has been at it fifty-fifty longer, amongst similar results.

We seem to conduct maintain inwards front end of us a pretty clear measure that long run dynamics are stable.

"Nothing" is astounding. This domestic dog that did non bark has demolished a lot of macroeconomic beliefs:

- MV = PY. Sorry, nosotros loved you. But when reserves larn from $50 billion to $3 trillion in addition to null at all happens to inflation -- or at most we're argument virtually pct points -- it has to exit the window.

- Keynesian deflationary spirals. Just every bit much every bit monetarists worried virtually hyperinflation, Keyensians' forecast of a deflationary spiral merely didn't happen.

- The Philips curve. Unemployment went to levels non seen since the keen depression; the output gap went to 10 percent in addition to ... inflation moved less than 1 percent. Adieu. (Actually, Phillips bend lovers plough this on its head, to proclaim that all nosotros demand is 1% to a greater extent than inflation to convey the economic scheme roaring back, but y'all tin mail away encounter how tortured that 1 is.)

- Fiscal stimulus... well, we'll conduct maintain that upward some other day

So, I convey y'all the question, which is non so obvious every bit Nick makes it sound.

If the Fed completely in addition to permanently pegs involvement rates, is inflation in the long run stable or unstable?

In response to shocks (left arrows) in addition to afterwards a menstruum of short-run dynamics (squiggly path), volition inflation eventually furnish to the Fisher relation?

Or, volition inflation eventually diverge -- until the Fed gives upward on the target?

The neo-Fisherian persuasion says the Fed is holding the broom correct side up, though maybe inwards a gale. To deed the bottom to the left, deed the transcend to the left, in addition to wait. But alas, the broom sweeper has thought it was unstable all these years, so has been moving the grip around a lot.

For Keynesian models, I similar really much John Taylor 1999 Journal of Monetary Economics This newspaper (or at to the lowest degree my reading of it starting p. 601 here) shows that old-Keynesian models amongst fixed involvement charge per unit of measurement targets are unstable, amongst explosive eigenvalues. Adopting a Taylor dominion amongst inflation coefficient greater than 1 makes the economic scheme stable -- the Taylor dominion says, deed the broom grip to a greater extent than than the transcend of the upside-down broom is moving, in addition to you'll move along it balanced.

For monetarism, read (re-read!) Milton Friedman's "Role of monetary policy" starting on p. five regarding involvement charge per unit of measurement pegs.

Adaptive expectations are, I think, the key features that brand these models unstable. By contrast, new-Keynesian models, amongst rational forward-looking expectations scope stability amongst involvement charge per unit of measurement pegs. They scope besides much stability, in addition to thence multiple equilibria. (Stephanie Schmitt-Grohe' in addition to Martin Uribe's papers on this theme are a skillful house to look.) Fiscal theory removes the indeterminacy, so seems to give a determinate Neo-Fisherian answer. And it empahsizes, that what volition hand both inwards the brusk in addition to long run depends on financial policy.

At the cost of repeating myself (this agency you, Nick!) the number is the long run stability of inflation nether an involvement charge per unit of measurement peg (and appropriate financial policy!), non short-run dynamics. And it's non so slowly to tease out of the data, though for certain worth the challenge. Influenza A virus subtype H5N1 clever VAR, noting periods of forced pegging due to the null bound, mightiness help.