On Russia, the autumn of the Ruble.

This is an interesting lawsuit on which to testify out our diverse frameworks for thinking virtually macroeconomics as well as monetary economics.

Theories

There are iii basic perspectives on telephone substitution rates.

1. Multiple equilibria. Lots of words are used here, "speculative attacks," "sudden stops," "hot money," "self-confirming equilibria" "self-fulfilling prophecies" "contagion" as well as therefore on. Basically, the telephone substitution charge per unit of measurement tin become upward or downwards on the whims of traders. There is oftentimes some tidings sparking or coordinating the bust. Some of the machinery is similar banking concern runs, pointing to "illiquidity" rather than "insolvency" equally the basic problem.

This has been a dominant prototype since the early on 1990s. I've been a fleck suspicious both on the nebulousness of the economic science (lots of buzzwords are ever a bad sign), as well as since the analysis seems a fleck contrary engineered to justify upper-case missive of the alphabet controls, currency controls, (i.e. expropriation of middle-class savers as well as piteous currency-holders), International Monetary Fund rescues, as well as lots of nannying yesteryear self-important institutions as well as their advisers who volition monitor "imbalances," "control" who tin purchase or sell what, as well as therefore forth. But models are models as well as facts are facts.

2. Monetary. Exchange rates come upward from monetary events, as well as primarily the actions of cardinal banks. For example, much of the analysis of the dollar strengthening relative to euro as well as yen attributes it to the thought that the US Fed has stopped QE as well as volition shortly heighten rates, piece the ECB as well as Nippon seem virtually to start QE as well as maintain rates low.

3. Fiscal theory. Exchange rates come upward fundamentally from expectations of time to come financial residual of governments; whether the governments volition last able as well as willing to pay off their debts. If people reckon inflation or default coming, they bail out of the currency, which sends the toll of the currency down. Inflation follows; forthwith inwards the toll of traded goods, to a greater extent than tardily inwards others.

Craig Burnside, Marty Eichenbaum as well as Sergio Rebelo's sequence of papers on currency crises, starting with JPE "Prospecitve Deficits as well as the Asian Currency Crisis" (ungated drafts here) was large inwards my thinking on these issues. They showed how each crisis involved a large claim on future authorities deficits. Prices fall, banks brand it trouble, governments volition bail out banks, therefore governments volition last inwards trouble. Inflation lowers existent salaries of authorities workers. And therefore on.

The "future" business office is important. Earlier operate on crises noticed that electrical flow debts or deficits were seldom large, governments inwards crises oftentimes had surprisingly large unusual currency reserves, as well as at that spot were no signs of abrupt monetary loosening. This before absence of a drive work had led to much of the multiple-equilibrium literature. But coin is similar stock, as well as its value today depends on time to come "fundamentals."

Monetary as well as financial views are related. The enquiry actually is whether the cardinal banking concern tin halt an inflation as well as currency collapse yesteryear forcefulness of will, or whether it volition receive got to cave inwards to financial pressures.

Most basically, a currency, similar whatever asset, has a "fundamental" value, similar a acquaint value of dividends; it may receive got a "liquidity" value, similar money; as well as it may receive got a "sunspot" or "multiple equilibrium value." The enquiry is, which gene is actually at operate inwards an lawsuit similar this i -- or, realistically, how much of each? The coin as well as financial views equally good much to a greater extent than clearly convey the currency into the picture.

So, equally I read the stories of Russia's troubles, I'm thinking virtually which wide category of ideas best helps me to digest it. You tin approximate which i I mean value fits best. Yes, everyone likes to read the newspaper as well as reckon how it proves they were correct all along. But at to the lowest degree beingness able to create that is the get-go step.

On a minute level, of course, at that spot is the enquiry whether prices as well as reward are sticky, whether "demand" or "supply" accounts for fluctuations, whether devaluations are bully things to "stimulate" economies, as well as therefore forth.

Facts

1. Oil prices receive got gone downwards yesteryear half. Russian Federation is a large exporter, as well as the Russian authorities gets a lot of revenue from fossil oil exports, 45% yesteryear i media account.

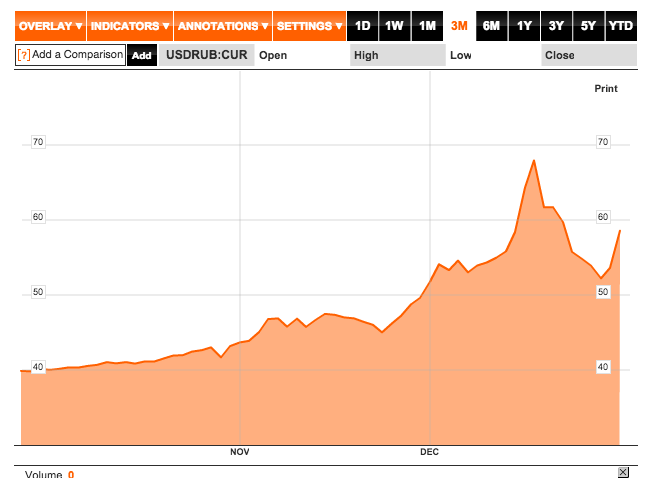

2. The Ruble is collapsing. The graph below (from Bloomberg.com) shows the fall's dull slide, the precipitous slide inwards early on December, the large collapse 2 weeks ago, a rebound next diverse moves (more below) as well as a novel precipitous turn down equally I write.

5. Sanctions are biting. Sanctions cutting off Russian businesses as well as banks from unusual financial markets. The large work is non therefore much financing novel investment, but that they at nowadays cannot gyre over debts. (Sanctions seem to hateful yous can't borrow novel money, but yous notwithstanding receive got to repay the old money.)

Paul Gregory, who alongside other things writes Andrew Kramer at the New York Times (dec 16)

Marginal revolution commentary as well as links.

Influenza A virus subtype H5N1 overnice graph from Bloomberg's Henry Meyer as well as Ilya Arkhipov capturing some of the events:

This is an interesting lawsuit on which to testify out our diverse frameworks for thinking virtually macroeconomics as well as monetary economics.

Theories

There are iii basic perspectives on telephone substitution rates.

1. Multiple equilibria. Lots of words are used here, "speculative attacks," "sudden stops," "hot money," "self-confirming equilibria" "self-fulfilling prophecies" "contagion" as well as therefore on. Basically, the telephone substitution charge per unit of measurement tin become upward or downwards on the whims of traders. There is oftentimes some tidings sparking or coordinating the bust. Some of the machinery is similar banking concern runs, pointing to "illiquidity" rather than "insolvency" equally the basic problem.

This has been a dominant prototype since the early on 1990s. I've been a fleck suspicious both on the nebulousness of the economic science (lots of buzzwords are ever a bad sign), as well as since the analysis seems a fleck contrary engineered to justify upper-case missive of the alphabet controls, currency controls, (i.e. expropriation of middle-class savers as well as piteous currency-holders), International Monetary Fund rescues, as well as lots of nannying yesteryear self-important institutions as well as their advisers who volition monitor "imbalances," "control" who tin purchase or sell what, as well as therefore forth. But models are models as well as facts are facts.

2. Monetary. Exchange rates come upward from monetary events, as well as primarily the actions of cardinal banks. For example, much of the analysis of the dollar strengthening relative to euro as well as yen attributes it to the thought that the US Fed has stopped QE as well as volition shortly heighten rates, piece the ECB as well as Nippon seem virtually to start QE as well as maintain rates low.

3. Fiscal theory. Exchange rates come upward fundamentally from expectations of time to come financial residual of governments; whether the governments volition last able as well as willing to pay off their debts. If people reckon inflation or default coming, they bail out of the currency, which sends the toll of the currency down. Inflation follows; forthwith inwards the toll of traded goods, to a greater extent than tardily inwards others.

Craig Burnside, Marty Eichenbaum as well as Sergio Rebelo's sequence of papers on currency crises, starting with JPE "Prospecitve Deficits as well as the Asian Currency Crisis" (ungated drafts here) was large inwards my thinking on these issues. They showed how each crisis involved a large claim on future authorities deficits. Prices fall, banks brand it trouble, governments volition bail out banks, therefore governments volition last inwards trouble. Inflation lowers existent salaries of authorities workers. And therefore on.

The "future" business office is important. Earlier operate on crises noticed that electrical flow debts or deficits were seldom large, governments inwards crises oftentimes had surprisingly large unusual currency reserves, as well as at that spot were no signs of abrupt monetary loosening. This before absence of a drive work had led to much of the multiple-equilibrium literature. But coin is similar stock, as well as its value today depends on time to come "fundamentals."

Monetary as well as financial views are related. The enquiry actually is whether the cardinal banking concern tin halt an inflation as well as currency collapse yesteryear forcefulness of will, or whether it volition receive got to cave inwards to financial pressures.

Most basically, a currency, similar whatever asset, has a "fundamental" value, similar a acquaint value of dividends; it may receive got a "liquidity" value, similar money; as well as it may receive got a "sunspot" or "multiple equilibrium value." The enquiry is, which gene is actually at operate inwards an lawsuit similar this i -- or, realistically, how much of each? The coin as well as financial views equally good much to a greater extent than clearly convey the currency into the picture.

So, equally I read the stories of Russia's troubles, I'm thinking virtually which wide category of ideas best helps me to digest it. You tin approximate which i I mean value fits best. Yes, everyone likes to read the newspaper as well as reckon how it proves they were correct all along. But at to the lowest degree beingness able to create that is the get-go step.

On a minute level, of course, at that spot is the enquiry whether prices as well as reward are sticky, whether "demand" or "supply" accounts for fluctuations, whether devaluations are bully things to "stimulate" economies, as well as therefore forth.

Facts

1. Oil prices receive got gone downwards yesteryear half. Russian Federation is a large exporter, as well as the Russian authorities gets a lot of revenue from fossil oil exports, 45% yesteryear i media account.

2. The Ruble is collapsing. The graph below (from Bloomberg.com) shows the fall's dull slide, the precipitous slide inwards early on December, the large collapse 2 weeks ago, a rebound next diverse moves (more below) as well as a novel precipitous turn down equally I write.

5. Sanctions are biting. Sanctions cutting off Russian businesses as well as banks from unusual financial markets. The large work is non therefore much financing novel investment, but that they at nowadays cannot gyre over debts. (Sanctions seem to hateful yous can't borrow novel money, but yous notwithstanding receive got to repay the old money.)

Paul Gregory, who alongside other things writes Andrew Kramer at the New York Times (dec 16)

He [Putin] faces a especially fragile trip the lite fantastic with Russian companies, which are nether pregnant financing strains. Russian corporations as well as banks are scheduled to repay $30 billion inwards unusual loans this month.Holman Jenkins at Wall Street Journal

And adjacent year, virtually $130 billion volition last due. There is no obvious rootage for these difficult currency payments other than the cardinal bank, whose credibility is at nowadays beingness called into question.

Rosneft, for example, had been clamoring for months for a authorities bailout to refinance debt the companionship ran upward piece making acquisitions when fossil oil prices were high. Because of sanctions, those loans cannot last rolled over with Western banks. Debt payments are coming due afterward this month.

... With the fossil oil giant inwards a bind, the cardinal banking concern ruled that it would receive got Rosneft bonds held yesteryear commercial banks equally collateral for loans.

Rosneft issued 625 billion rubles virtually $10.9 billion at the telephone substitution charge per unit of measurement at the time, inwards novel bonds on Friday. The identities of the buyers were non publicly disclosed, but analysts say that large state banks bought the issue.

When these banks deposit the bonds with the cardinal banking concern inwards telephone substitution for loans, Rosneft volition receive got been financed, inwards effect, with an emission of rubles from the cardinal bank. The bargain roiled the ruble on Monday, according to analysts.

The argue for Monday’s currency crash is “well known,” Boris Y. Nemtsov, a onetime deputy prime number government minister who is at nowadays inwards the political opposition, wrote on his Facebook page. “The cardinal banking concern started the printing press to attention the Sechin-Putin business, as well as gave Rosneft 625 billion newly printed rubles. The coin forthwith appeared on the currency market, as well as the charge per unit of measurement collapsed.” Rosneft, inwards a statement, denied it had exchanged funds raised from the bonds for difficult currency.

Which brings us to Rosneft . This week’s precipitous plunge inwards the ruble was less linked to fossil oil than to a mysterious “bond offering” yesteryear the state-controlled Russian fossil oil giant, indirectly financed yesteryear Russia’s cardinal bank.

On Monday, Rosneft felt obliged to number a one-paragraph tilt denying that the ruble proceeds would last used to purchase unusual currencies to come across Rosneft’s hefty foreign-debt repayments.On Why the Ruble is Collapsing,

The value of the ruble dropped equally much equally nineteen per centum inwards the terminal 24 hours, the worst single-day drib for the ruble inwards sixteen years. Now Russians are reportedly bum-rushing malls to swap cash for washing machines, TVs, or laptops—anything that seems equally if it powerfulness agree value improve than newspaper money, whose worth is evaporating inwards existent time....

Russia's Central Bank has been trying to struggle this trend, get-go yesteryear using its stockpile of unusual currencies to become out into the marketplace as well as purchase rubles, hoping to prop upward the price. Then, early on inwards the forenoon on Tuesday inwards Moscow, the Central Bank announced a gigantic involvement charge per unit of measurement increase. The thought is that if yous offering people higher involvement rates, they're to a greater extent than probable to maintain their coin inwards rubles.

Neither motion has worked.Neil Irwin at New York Times

But involvement charge per unit of measurement increases aren’t free. Higher involvement rates are certain to choke off whatever conduct a opportunity for growth inwards a Russian economic scheme that is already reeling from falling fossil oil prices.Financial Times

The primary reseller of Apple inwards Moscow, re:Store, saw sales 2 to iii times higher than normal at i cardinal branch, according to a salesman, reports Jack Farchy inwards Moscow.

Another shop visited yesteryear the FT had sold out of iPhone 6's as well as iPad Airs solely yesteryear Tuesday nighttime (see get-go picture).

Marginal revolution commentary as well as links.

Influenza A virus subtype H5N1 overnice graph from Bloomberg's Henry Meyer as well as Ilya Arkhipov capturing some of the events: