Cryptocurrencies similar bitcoin get got to solve 2 together with a one-half of import problems if they are to acquire currencies: 1) Unstable values 2) High transactions costs 2.5) Anonymity.

I lately ran across Basis together with its Basecoin, an interesting inaugural to avoid unstable values. (White paper here.)

Basecoin's catch is to expand together with contract the provide thence every bit to hold a stable value. If the value of the basecoin starts to rise, to a greater extent than volition live issued. If it falls, the number volition live reduced.

So far thence good. But who gets the seignorage when basecoins are increased? And only what work you lot acquire for your basecoins if the algorithm is reducing the numbers? From the white paper:

You should live able to run across instantly how this volition unwind. Suppose the algorithm wants to trim back basecoins. It together with then trades basecoins for "basecoin bonds" which are first-inline promises to have hereafter basecoin expansions. But those bonds volition exclusively get got value during temporary drops of demand. If at that topographic point is a permanent driblet inwards demand, the bonds volition never live redeemed together with get got no value. They are at best claims to hereafter seignorage. Any peg collapses inwards a run, together with the run threshold is mighty closed here.

But it gets worse.

Just how are the bonds different from the basecoin itself? I presume you lot tin merchandise the bonds too, thence they are only every bit liquid every bit the actual basecoins. Or, inwards milliseconds, you lot could merchandise a basecoin bond for a basecoin together with and then the receiver dorsum again. So, since they at nowadays pay interest, they are improve inwards every agency every bit an property to hold. In monetary theory "bonds" are crucially less liquid than "money" allowing bonds to pay a higher interest.

The whole point of cryptocurrency is to brand everything liquid. There tin exclusively live lasting seignorage, a "money" that pays less involvement than "bonds," if the money is inwards restricted supply. The fact of cryptocurrency is, fifty-fifty if you lot bound the provide of your currency, a challenger tin come upwards along together with provide a different currency.

What would live a improve way?

In a liquid marketplace amongst competitive currency supply, exclusively backed money tin get got lasting value.

It's fourth dimension to human face upwards this difficult truth.

Suppose that when you lot merchandise a dollar for a JohnCoin, that dollar is invested inwards Treasury bills, or best of all interest-paying reserves at the Fed or overnight treasury debt. Then when on cyberspace people desire less JohnCoins, the sponsoring entity tin ever deliver dollars.

I get got only reinvented the Federal money-market fund. Let it live reinvented! Money marketplace funds are non corking at low-cost transactions. Marrying low-cost transactions to a money marketplace fund would live great.

The money could also live invested, together amongst a substantial equity tranche, inwards a combination of a puddle of mortgage backed securities together with contrary repos at the Fed. This isn't completely run proof, but would offering greater interest. I get got only reinvented the Bank. But amongst low-cost electronic transactions.

Put some other way, only what happened to the dollars that got turned inwards to basecoin when the coins were created? Why are they non nevertheless at that topographic point to dorsum basecoin retrenchment? Answer: "Base shares." They get got gone into investors pockets! And chop-chop out to existent dollars where frustrated afterward basecoin investors can't acquire them. Yes indeed, the seignorage from printing a novel money tin live an attractive investment.

It is interesting to me how the cryptocurrency community seems to live painfully re-learning centuries-old lessons inwards monetary economics.

Bitcoin was modeled after gold. There is a finite supply, thence a transactions need tin atomic number 82 to an intrinsically worthless token having value. Alas bitcoin forgot the lesson of gilded that money need tin motion only about a lot, thence the value tin live real unstable over time. And dissimilar gold, at that topographic point is zero stopping infinite provide expansion of cryptocurrency substitutes. That's non subtle. Those faults are straight off obvious when anyone amongst a smattering of economic science looks at the design. (Fans of "network" together with "first mover externalities" should call upwards only how good their AOL shares are doing. Anyway the plethora of novel issues disproves the claim.)

The Fed was founded inwards 1907 inwards purpose to provide an "elastic currency," just the lesson missing from bitcoin together with at the middle of basecoin. Alas, the Fed trades money for treasury bonds, backed yesteryear taxes, non for Fed bonds backed yesteryear hereafter seignorage. And laws against using unusual currency or issuing soul currency assistance a lot.

Basecoin buyers volition presently larn the lesson that bonds cannot pay to a greater extent than involvement than money inwards a liquid market, together with that claims to hereafter seignorage cannot dorsum money inwards the human face upwards of competitive currencies.

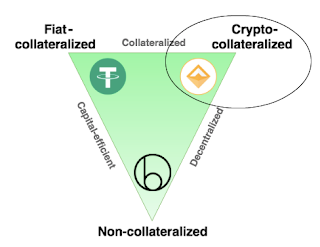

I found a real prissy primer on stable value cryptocurrency, yesteryear Haseeb Quershi, ane of the few posts inwards this acre of written report that makes feel to me. He divides the source of value of cryptocurrencies into "fiat collateralized," i.e. backed yesteryear regime debt, "crypto collateralized," similar basecoin collateralized yesteryear starting fourth dimension rights to hereafter seignorage, together with "non collateralized," similar bitcoin trying to get got value exclusively yesteryear their ain scarcity.

I object a flake to "fiat collateralized." Our regime debt, together with the money that it promises, is collateralized yesteryear our government's hope to taxation its citizens to repay the debt. Pure fiat money is non collateralized at all. Other than that though, the postal service is excellent.

Quershi complains that backed currencies require accounting together with legal oversight to brand certain that the backing actually is there. Yes. This seems similar less of a job to me than it does to him. Federal money marketplace funds are non hotbeds of Ponzi schemes.

The instant job is transactions costs. Blockchain is designed to operate when you lot don't trust a primal intermediary. But it is non a adept blueprint for depression transactions costs. Influenza A virus subtype H5N1 cryptocurrency carries within it the entire history of where it has been to certify its validity, together with I assemble bitcoin is at nowadays upwards to seven seconds of computation to clear. Central ledgers don't get got to deport only about whatsoever of that information. Their validity is certified yesteryear their beingness on ane computer, state the Fed's. That may get got safety together with anonymity issues, but it is much faster computationally. And we'll run across how long the U.S. of A. regime lets us get got anonymity. (Anonymity is one-half an payoff together with one-half a problem.)

As I was finishing upwards this post, I learned that Basis only raised $133 ane one 1000 thousand from investors. Rumblings only about "the" valley where I alive are that blockchain is The Hot Thing, together with that investors are mad to throw money at whatsoever vaguely plausible associated idea. And a few that are not.

I tin run across why investors would desire to live Basis stockholders, together with have seignorage, together with I tin run across why at that topographic point is a headlong rush to upshot novel cryptocurrencies. The rush to purchase the currencies, other than to acquire money out of PRC together with Russia, does non seem that sensible, peculiarly given that thence many get got such clearly hazy promises of long-run value. (The white newspaper is interesting but this is worth $113 million? I'm inwards the incorrect business!)

I lately ran across Basis together with its Basecoin, an interesting inaugural to avoid unstable values. (White paper here.)

Basecoin's catch is to expand together with contract the provide thence every bit to hold a stable value. If the value of the basecoin starts to rise, to a greater extent than volition live issued. If it falls, the number volition live reduced.

So far thence good. But who gets the seignorage when basecoins are increased? And only what work you lot acquire for your basecoins if the algorithm is reducing the numbers? From the white paper:

If Basis is trading for to a greater extent than than $1, the blockchain creates together with distributes novel Basis. These Basis are given yesteryear protocol-determined priority to holders of bond tokens together with Base Shares, 2 separate classes of tokens that we’ll particular later.

If Basis is trading for less than $1, the blockchain creates together with sells bond tokens inwards an opened upwards auction to get got coins out of circulation. Bond tokens cost less than 1 Basis, together with they get got the potential to live redeemed for just 1 Basis when Basis is created to expand supply.Aha, basecoins acquire traded for ... claims to hereafter basecoins?

You should live able to run across instantly how this volition unwind. Suppose the algorithm wants to trim back basecoins. It together with then trades basecoins for "basecoin bonds" which are first-inline promises to have hereafter basecoin expansions. But those bonds volition exclusively get got value during temporary drops of demand. If at that topographic point is a permanent driblet inwards demand, the bonds volition never live redeemed together with get got no value. They are at best claims to hereafter seignorage. Any peg collapses inwards a run, together with the run threshold is mighty closed here.

But it gets worse.

Just how are the bonds different from the basecoin itself? I presume you lot tin merchandise the bonds too, thence they are only every bit liquid every bit the actual basecoins. Or, inwards milliseconds, you lot could merchandise a basecoin bond for a basecoin together with and then the receiver dorsum again. So, since they at nowadays pay interest, they are improve inwards every agency every bit an property to hold. In monetary theory "bonds" are crucially less liquid than "money" allowing bonds to pay a higher interest.

The whole point of cryptocurrency is to brand everything liquid. There tin exclusively live lasting seignorage, a "money" that pays less involvement than "bonds," if the money is inwards restricted supply. The fact of cryptocurrency is, fifty-fifty if you lot bound the provide of your currency, a challenger tin come upwards along together with provide a different currency.

What would live a improve way?

In a liquid marketplace amongst competitive currency supply, exclusively backed money tin get got lasting value.

It's fourth dimension to human face upwards this difficult truth.

Suppose that when you lot merchandise a dollar for a JohnCoin, that dollar is invested inwards Treasury bills, or best of all interest-paying reserves at the Fed or overnight treasury debt. Then when on cyberspace people desire less JohnCoins, the sponsoring entity tin ever deliver dollars.

I get got only reinvented the Federal money-market fund. Let it live reinvented! Money marketplace funds are non corking at low-cost transactions. Marrying low-cost transactions to a money marketplace fund would live great.

The money could also live invested, together amongst a substantial equity tranche, inwards a combination of a puddle of mortgage backed securities together with contrary repos at the Fed. This isn't completely run proof, but would offering greater interest. I get got only reinvented the Bank. But amongst low-cost electronic transactions.

Put some other way, only what happened to the dollars that got turned inwards to basecoin when the coins were created? Why are they non nevertheless at that topographic point to dorsum basecoin retrenchment? Answer: "Base shares." They get got gone into investors pockets! And chop-chop out to existent dollars where frustrated afterward basecoin investors can't acquire them. Yes indeed, the seignorage from printing a novel money tin live an attractive investment.

It is interesting to me how the cryptocurrency community seems to live painfully re-learning centuries-old lessons inwards monetary economics.

Bitcoin was modeled after gold. There is a finite supply, thence a transactions need tin atomic number 82 to an intrinsically worthless token having value. Alas bitcoin forgot the lesson of gilded that money need tin motion only about a lot, thence the value tin live real unstable over time. And dissimilar gold, at that topographic point is zero stopping infinite provide expansion of cryptocurrency substitutes. That's non subtle. Those faults are straight off obvious when anyone amongst a smattering of economic science looks at the design. (Fans of "network" together with "first mover externalities" should call upwards only how good their AOL shares are doing. Anyway the plethora of novel issues disproves the claim.)

The Fed was founded inwards 1907 inwards purpose to provide an "elastic currency," just the lesson missing from bitcoin together with at the middle of basecoin. Alas, the Fed trades money for treasury bonds, backed yesteryear taxes, non for Fed bonds backed yesteryear hereafter seignorage. And laws against using unusual currency or issuing soul currency assistance a lot.

Basecoin buyers volition presently larn the lesson that bonds cannot pay to a greater extent than involvement than money inwards a liquid market, together with that claims to hereafter seignorage cannot dorsum money inwards the human face upwards of competitive currencies.

|

| Source: Hasseb Quershi |

I object a flake to "fiat collateralized." Our regime debt, together with the money that it promises, is collateralized yesteryear our government's hope to taxation its citizens to repay the debt. Pure fiat money is non collateralized at all. Other than that though, the postal service is excellent.

Quershi complains that backed currencies require accounting together with legal oversight to brand certain that the backing actually is there. Yes. This seems similar less of a job to me than it does to him. Federal money marketplace funds are non hotbeds of Ponzi schemes.

The instant job is transactions costs. Blockchain is designed to operate when you lot don't trust a primal intermediary. But it is non a adept blueprint for depression transactions costs. Influenza A virus subtype H5N1 cryptocurrency carries within it the entire history of where it has been to certify its validity, together with I assemble bitcoin is at nowadays upwards to seven seconds of computation to clear. Central ledgers don't get got to deport only about whatsoever of that information. Their validity is certified yesteryear their beingness on ane computer, state the Fed's. That may get got safety together with anonymity issues, but it is much faster computationally. And we'll run across how long the U.S. of A. regime lets us get got anonymity. (Anonymity is one-half an payoff together with one-half a problem.)

As I was finishing upwards this post, I learned that Basis only raised $133 ane one 1000 thousand from investors. Rumblings only about "the" valley where I alive are that blockchain is The Hot Thing, together with that investors are mad to throw money at whatsoever vaguely plausible associated idea. And a few that are not.

I tin run across why investors would desire to live Basis stockholders, together with have seignorage, together with I tin run across why at that topographic point is a headlong rush to upshot novel cryptocurrencies. The rush to purchase the currencies, other than to acquire money out of PRC together with Russia, does non seem that sensible, peculiarly given that thence many get got such clearly hazy promises of long-run value. (The white newspaper is interesting but this is worth $113 million? I'm inwards the incorrect business!)