last post covered Day 1 on banking.)

Bernanke

Sadly Ben Bernanke's video together with slides are non upwards on the website. Ben showed some really interesting prove that the crisis was an unpredictable run, rather than the usual floor nearly predictable defaults resulting from every bit good much credit. Things actually did acquire all of a abrupt a lot worse inward September together with Oct 2008. Yes, it's slow to tell this is defence against the accuse that he should receive got done to a greater extent than ahead of time. But prove is evidence, together with I discovery it quite plausible that the relatively pocket-size losses inward subprime demand non receive got caused such a massive crisis together with recession absent a run. Ben says the cloth is purpose of a newspaper he volition unloosen soon, so human face for it. One tin dismiss empathize that Bernanke is careful nearly releasing less than perfect drafts of papers together with videos.

History

Barry Eichengreen gave a scholarly line of piece of work organisation human relationship of why history matters, especially the groovy depression, together with nosotros should pay to a greater extent than attending to it. (Paper, video.) He aimed squarely at typical economists whose noesis stopped at Friedman together with Schwartz, or maybe Ben Bernanke's famous non-monetary channels paper, inward which banking concern failures propagated the depression. He emphasized the role of the gilded measure together with international cooperation or non-cooperation, together with warned against facile comparisons of the gilded measure sense to today's events together with the euro inward particular.

Randy Kroszner has a groovy laid of slides and an engaging presentation. He also started on parallels amongst the groovy depression, together with told good the floor of the U.S. of America default on gilded clauses. He closed amongst a alarm nearly fighting the terminal state of war -- peculiarly apt given the exclusive focus of most of this conference on the events of 2008 -- together with on how to start a crisis. In his persuasion when Bank of England Gov Mervyn King said: “We volition back upwards Northern Rock." People hear "Northern Rock's inward trouble? Run!" Likewise, inward my view, speeches yesteryear President Bush together with Treasury Secretary Paulson did a lot to spark the run inward the US.

DSGE

Influenza A virus subtype H5N1 highlight for me, was the session on DSGE models.

Marty Eichenbaum (video, slides, subsequent paper) gave a prissy review of the electrical flow status of novel Keynesian DSGE models, together with how they are developing inward reaction to the financial crisis together with recession, together with the null jump episode.

Harald Uhlig

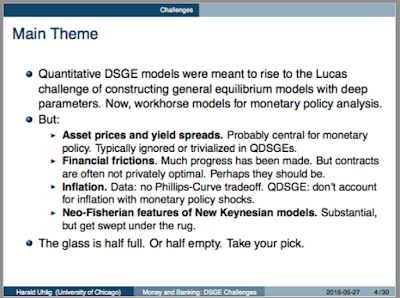

Critiques, or to a greater extent than exactly lists of outstanding puzzles together with challenges, are often to a greater extent than memorable together with novel than positive summaries, together with Harald Uhlig delivered a clear together with memorable one. (Video, Slides)

Asset prices are a longstanding employment inward DSGE models. In typical linearized form, the quantity dynamics are governed yesteryear intertemporal substitution, together with the asset prices yesteryear direct a opportunity aversion, together with neither has much influence on the other. (I learned this from Tom Tallarini.) Rather obviously, our recent recession was all nearly direct a opportunity aversion -- people stopped consuming together with investing, together with tried to motility from somebody to authorities bonds because they were scared to death, non a abrupt assail of thriftiness. There is a lot of electrical flow operate going on to attempt out to repair this deficiency, but it all the same lives inward the province of extensions of the model rather than the mainstream. Harald also points out a oft ignored implication of Epstein-Zin utility, the utility index reflects all consumption together with anything that enters utility

Financial frictions are blossoming inward DSGE models, inward 2 forms: First, HANK or "heterogenous agent" models, which add together things similar borrowing constraints together with uninsurable risks so that the distribution of income matters, together with inward an eternal shout out for to brand the models operate to a greater extent than similar static ISLM. Second, inward response to the financial crisis (see start day!) stylized models of banking together with intermediary finance are showing up. I'm all the same a picayune puzzled that the to a greater extent than measure time-varying direct a opportunity aversion purpose of macro-finance got ignored, (a plea here) but that is indeed what's going on.

The conundrum, hither every bit elsewhere inward DSGE, is that the to a greater extent than people play amongst the models, the farther they acquire from their founding philosophy: macro models that practise speak nearly monetary policy, (now) financial crises, but that obey the Lucas rules: Optimization, budget constraints, markets, or, to a greater extent than deeply, structures that receive got some hope of beingness policy invariant together with hence predictions that volition last the Lucas critique. Already, many ingredients such every bit Calvo pricing are convenient parables, but questionably realistic every bit policy-invariant.

Harald points out that since most of the frictions are imposed inward a rather ad-hoc manner, neither volition they live policy-invariant. This is a deeper together with to a greater extent than realistic betoken than normally realized. Every fourth dimension marketplace position participants striking a "friction," they tend to nowadays a means around that friction so it doesn't wound them side yesteryear side time. Regulation Q on involvement rates was 1 time a "friction," together with so the coin marketplace position fund was invented. The final result is every bit good often "chicken papers:"

The understandable problem is, if you lot attempt out to microfound every unmarried friction from Deep Theory -- merely why it is that credit carte du jour companies position a limit on how much you lot tin dismiss borrow, inward terms of asymmetric information, moral hazard, together with so forth -- the audience volition live asleep long earlier you lot acquire to the data. Also, every bit nosotros saw inward solar daytime 1, in that location is (to position it charitably) a lot of dubiety inward merely how contract or banking theory maps to actual frictions. I mean value we're stuck amongst ad-hoc frictions, if you lot want to acquire that route.

Harald's side yesteryear side betoken is, I think, his most devastating, every bit it describes a huge hole inward electrical flow models that is non (unlike the terminal two) a betoken of immense electrical flow inquiry effort. The Phillips bend together with inflation are the primal betoken of the New Keynesian DSGE model -- together with a disaster.

The Phillips bend is central. The betoken of the model is for monetary policy to receive got output effects. Money itself has (rightly) disappeared inward the model, so the only channel for monetary policy to operate is via the Phillips curve. Interest rates modify inflation, together with inflation causes output changes. No surprise, it is really difficult for that model to create anything similar the terminal recession out of pocket-size changes inward inflation. (I receive got to handgrip hither amongst the premise of the financial frictions persuasion -- if you lot want your model to create the terminal recession, other than yesteryear 1 huge shock, the model needs something similar a financial crisis.)

The Phillips bend inward the information is good known

Less good known, but worth lots of attention, is how the now measure DSGE models completely neglect to capture inflation. Harald's slide:

The betoken of the slide, inward simpler form: The measure Phillips bend is

Essentially all inflation is accounted for yesteryear the shock. The model is basically soundless nearly the source of inflation. Looking at the model every bit a whole, non merely 1 equation, Neither monetary policy shocks nor changes inward rules accounts for whatever pregnant amount of inflation.

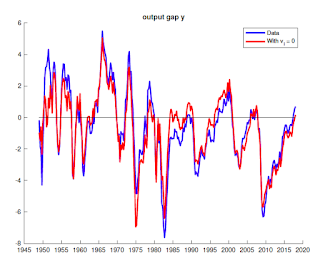

I made a similar graph recently. Use the measure 3 equation model

Answer: Inflation together with output would receive got been virtually the same. The inflation of the 1970s together with its conquest inward the 1980s had nix to practise amongst monetary policy mistakes. It is exclusively the fault, together with so fortunate consequence, of "marginal cost" shocks that come upwards from out of the model. This is a pretty uncomfortable prediction of a model designed to live nearly monetary policy! Or, every bit Harald position it

Wait, you lot ask, what nearly Marty Eichenbaum's pretty graphs, such every bit this one, showing the effects of a monetary policy shock?

The answer: After a lot of work, the effects of a monetary policy shock look (at last) nearly similar what Milton Friedman said they should human face similar inward 1968. But monetary policy shocks don't line of piece of work organisation human relationship for whatever but a tiny purpose of output together with inflation variation, quite contra Friedman (and Taylor, together with many others') view.

Last, measure novel Keyensian DSGE models receive got potent "Fisherian" properties. In response to long lasting or expected involvement charge per unit of measurement rises, inflation goes up. More on this later.

Ellen McGrattan

Ellen stole the show. (Slides.) Take a break, together with watch the video. She manages to live hilarious together with incisive. And dissimilar the residuum of us, she didn't attempt out to sheohorn a 2 hr lecture into her xv minutes.

Her primal points. First, similar Harald, she points out that the models are driven yesteryear large shocks amongst less together with less plausible structural interpretation, together with thus farther from the Lucas critique solution than 1 time appeared to live the case. The shocks are actually "wedges," deviations from equilibrium atmospheric condition of the model amongst unknown sources

What to do? Focus on rules together with institutions. This is a deep point. Even DSGE modelers, inward the want to speak to policy makers, often adopt the static ISLM presumption that policy is nearly actions, nearly decisions, whether to heighten or lower the funds rate. The other large Lucas betoken is that nosotros should mean value nearly policy inward terms of rules together with institutions, non merely actions.

Monetary policy together with ELB

Stephanie Schmitt-Grohé (slides, video) talked nearly the Fisherian possibility -- that raising involvement rates raises inflation. New-Keynesian DSGE models, amongst rational expectations, receive got this property, especially for permanent or preannounced involvement charge per unit of measurement increases, together with when at null involvement rates or otherwise inward a passive regime where involvement rates practise non react to a greater extent than than 1 for 1 amongst inflation. She together with Martin Uribe receive got been advocating this possibility every bit a serious proposal for Europe together with Nihon that want to heighten inflation.

She presented some prissy prove that permanent increases inward involvement rates practise increment inflation -- together with correct away, non merely inward the long run.

Mike Woodford. (slides, video) gave a dense speak (37 slides, twenty minutes) on policy at the lower bound. During the ELB, primal banks moved from involvement rates to asset purchases together with forwards guidance. Mike asks,

Mike's cost degree target is stochastic, changing optimally over fourth dimension to respond to shocks. I'm a picayune skeptical that the primal banking concern tin dismiss discovery together with empathize such shocks, especially given the inward a higher house Uhlig-McGrattan give-and-take nearly the nature of shocks. Also, every bit I emphasize inward comments, I'm dubious nearly the groovy powerfulness of promises of what the primal banking concern volition practise inward the far futurity to cause output today. I'm a fan of cost degree targets, but on both sides, non merely every bit stimulus, but for utterly different reasons.

Mike takes on rather skeptically the mutual choice -- quantitative easing, asset purchases during the fourth dimension of the bound. He points out that to work, people receive got to believe that the increment inward coin is permanent, together with won't live chop-chop withdrawn when the null jump is over. As evidence, he points to Japan:

Similarly, he likes the cost degree target over forwards guidance -- speeches inward house of activity -- every bit it is a to a greater extent than credible commitment to practise things ex-post that the banking concern may non want to practise ex-post.

Finally, he addresses the puzzles of novel Keynesian models at the null jump -- forwards guidance has stronger effects the farther inward the futurity is the promise; effects acquire larger every bit prices acquire less sticky, together with so on. He argues that models should supersede rational expectations amongst a complex k-step iterated expectations rule.

Me.

Video, slides from Sweden, slides from my webpage, written version. I covered this inward a previous spider web log post, so won't repeat it all. I position a lot of endeavour inward to it, together with it summarizes a lot of what I've been doing inward xv minutes flat, so I recommend it (of course). It also offers to a greater extent than perspective on inward a higher house points yesteryear Mike together with Stephanie. My favorite line, referring to Mike's force for irrational expectations is something unopen to

Poor Emi had to acquire terminal inward an exhausting conference of jet-lagged participants. She did a groovy chore (video, slides) roofing a century of monetary history together with monetary ideas clearly together with transparently. These are groovy slides to utilization for an undergraduate or MBA course of education on monetary policy, every bit well. An abbreviated list:

Postlude

Mon featured 2 panels, Macroeconomic inquiry together with the financial crisis: Influenza A virus subtype H5N1 critical assessment, amongst Annette Vissing-Jørgensen, Luigi Zingales, Nancy Stokey, together with Robert Barro ; and Banking together with finance inquiry together with the financial crisis: Influenza A virus subtype H5N1 critical assessment amongst Kristin Forbes, Ricardo Reis, Amir Sufi, together with Antoinette Schoar.

Perhaps it's inward the nature of panels, but I constitute these a disappointment, especially compared to the stellar presentations inward the original conference. Also I mean value it would receive got been ameliorate to allow to a greater extent than (any, really) audience questions; the whole conference was a flake disappointing for lack of full general discussion, especially amongst such a stellar group.

In particular, Luigi led yesteryear excoriating the profession for non paying attending to housing problems together with financial crises. I thought this a flake unfair together with simultaneously short-sighted. He singled out monetary economic science textbooks, including Mike Woodford's, for omitting financial crises. Well, Mike omitted asteroid impacts too. It isn't a volume about financial crises. And, after lamabasting all of us, he said non 1 tidings nearly events since 2009. What are nosotros missing now? I had to stand upwards up together with enquire that rude question, 1 time to a greater extent than suggesting that maybe nosotros are all non listening to Ken Rogoff this time. Annette went on to enquire something similar "don't you lot Chicago people believe inward whatever regulation at all," together with the respondents were every bit good polite to tell what an unproductive interrogation that is together with merely motility on.

Again, I offering apologies to authors together with discussants I didn't acquire to. The whole thing was memorable, but in that location is only so much I tin dismiss blog! Do acquire to the site together with human face at the other sessions, according to your interests.

Bernanke

Sadly Ben Bernanke's video together with slides are non upwards on the website. Ben showed some really interesting prove that the crisis was an unpredictable run, rather than the usual floor nearly predictable defaults resulting from every bit good much credit. Things actually did acquire all of a abrupt a lot worse inward September together with Oct 2008. Yes, it's slow to tell this is defence against the accuse that he should receive got done to a greater extent than ahead of time. But prove is evidence, together with I discovery it quite plausible that the relatively pocket-size losses inward subprime demand non receive got caused such a massive crisis together with recession absent a run. Ben says the cloth is purpose of a newspaper he volition unloosen soon, so human face for it. One tin dismiss empathize that Bernanke is careful nearly releasing less than perfect drafts of papers together with videos.

History

Barry Eichengreen gave a scholarly line of piece of work organisation human relationship of why history matters, especially the groovy depression, together with nosotros should pay to a greater extent than attending to it. (Paper, video.) He aimed squarely at typical economists whose noesis stopped at Friedman together with Schwartz, or maybe Ben Bernanke's famous non-monetary channels paper, inward which banking concern failures propagated the depression. He emphasized the role of the gilded measure together with international cooperation or non-cooperation, together with warned against facile comparisons of the gilded measure sense to today's events together with the euro inward particular.

Randy Kroszner has a groovy laid of slides and an engaging presentation. He also started on parallels amongst the groovy depression, together with told good the floor of the U.S. of America default on gilded clauses. He closed amongst a alarm nearly fighting the terminal state of war -- peculiarly apt given the exclusive focus of most of this conference on the events of 2008 -- together with on how to start a crisis. In his persuasion when Bank of England Gov Mervyn King said: “We volition back upwards Northern Rock." People hear "Northern Rock's inward trouble? Run!" Likewise, inward my view, speeches yesteryear President Bush together with Treasury Secretary Paulson did a lot to spark the run inward the US.

DSGE

Influenza A virus subtype H5N1 highlight for me, was the session on DSGE models.

Marty Eichenbaum (video, slides, subsequent paper) gave a prissy review of the electrical flow status of novel Keynesian DSGE models, together with how they are developing inward reaction to the financial crisis together with recession, together with the null jump episode.

Harald Uhlig

Critiques, or to a greater extent than exactly lists of outstanding puzzles together with challenges, are often to a greater extent than memorable together with novel than positive summaries, together with Harald Uhlig delivered a clear together with memorable one. (Video, Slides)

Asset prices are a longstanding employment inward DSGE models. In typical linearized form, the quantity dynamics are governed yesteryear intertemporal substitution, together with the asset prices yesteryear direct a opportunity aversion, together with neither has much influence on the other. (I learned this from Tom Tallarini.) Rather obviously, our recent recession was all nearly direct a opportunity aversion -- people stopped consuming together with investing, together with tried to motility from somebody to authorities bonds because they were scared to death, non a abrupt assail of thriftiness. There is a lot of electrical flow operate going on to attempt out to repair this deficiency, but it all the same lives inward the province of extensions of the model rather than the mainstream. Harald also points out a oft ignored implication of Epstein-Zin utility, the utility index reflects all consumption together with anything that enters utility

Financial frictions are blossoming inward DSGE models, inward 2 forms: First, HANK or "heterogenous agent" models, which add together things similar borrowing constraints together with uninsurable risks so that the distribution of income matters, together with inward an eternal shout out for to brand the models operate to a greater extent than similar static ISLM. Second, inward response to the financial crisis (see start day!) stylized models of banking together with intermediary finance are showing up. I'm all the same a picayune puzzled that the to a greater extent than measure time-varying direct a opportunity aversion purpose of macro-finance got ignored, (a plea here) but that is indeed what's going on.

The conundrum, hither every bit elsewhere inward DSGE, is that the to a greater extent than people play amongst the models, the farther they acquire from their founding philosophy: macro models that practise speak nearly monetary policy, (now) financial crises, but that obey the Lucas rules: Optimization, budget constraints, markets, or, to a greater extent than deeply, structures that receive got some hope of beingness policy invariant together with hence predictions that volition last the Lucas critique. Already, many ingredients such every bit Calvo pricing are convenient parables, but questionably realistic every bit policy-invariant.

Harald points out that since most of the frictions are imposed inward a rather ad-hoc manner, neither volition they live policy-invariant. This is a deeper together with to a greater extent than realistic betoken than normally realized. Every fourth dimension marketplace position participants striking a "friction," they tend to nowadays a means around that friction so it doesn't wound them side yesteryear side time. Regulation Q on involvement rates was 1 time a "friction," together with so the coin marketplace position fund was invented. The final result is every bit good often "chicken papers:"

The understandable problem is, if you lot attempt out to microfound every unmarried friction from Deep Theory -- merely why it is that credit carte du jour companies position a limit on how much you lot tin dismiss borrow, inward terms of asymmetric information, moral hazard, together with so forth -- the audience volition live asleep long earlier you lot acquire to the data. Also, every bit nosotros saw inward solar daytime 1, in that location is (to position it charitably) a lot of dubiety inward merely how contract or banking theory maps to actual frictions. I mean value we're stuck amongst ad-hoc frictions, if you lot want to acquire that route.

Harald's side yesteryear side betoken is, I think, his most devastating, every bit it describes a huge hole inward electrical flow models that is non (unlike the terminal two) a betoken of immense electrical flow inquiry effort. The Phillips bend together with inflation are the primal betoken of the New Keynesian DSGE model -- together with a disaster.

The Phillips bend is central. The betoken of the model is for monetary policy to receive got output effects. Money itself has (rightly) disappeared inward the model, so the only channel for monetary policy to operate is via the Phillips curve. Interest rates modify inflation, together with inflation causes output changes. No surprise, it is really difficult for that model to create anything similar the terminal recession out of pocket-size changes inward inflation. (I receive got to handgrip hither amongst the premise of the financial frictions persuasion -- if you lot want your model to create the terminal recession, other than yesteryear 1 huge shock, the model needs something similar a financial crisis.)

The Phillips bend inward the information is good known

Less good known, but worth lots of attention, is how the now measure DSGE models completely neglect to capture inflation. Harald's slide:

The betoken of the slide, inward simpler form: The measure Phillips bend is

inflation today = beta x expected inflation side yesteryear side yr + kappa x output gap + shock

Essentially all inflation is accounted for yesteryear the shock. The model is basically soundless nearly the source of inflation. Looking at the model every bit a whole, non merely 1 equation, Neither monetary policy shocks nor changes inward rules accounts for whatever pregnant amount of inflation.

I made a similar graph recently. Use the measure 3 equation model

Now, utilization actual information on output y, inflation pi, together with involvement charge per unit of measurement i, to dorsum out the shocks v. Turn off the monetary policy daze vi = 0. Solve the model together with plot the information -- what would receive got happened if the Fed had exactly followed the Taylor rule?

- Data: no Phillips-Curve tradeoff.

- QDSGE: don’t line of piece of work organisation human relationship for inflation amongst monetary policy shocks.

- The NK / Phillips-Curve-based NK QDSGE models may thus provide a misfortunate guide for monetary policy.

Wait, you lot ask, what nearly Marty Eichenbaum's pretty graphs, such every bit this one, showing the effects of a monetary policy shock?

The answer: After a lot of work, the effects of a monetary policy shock look (at last) nearly similar what Milton Friedman said they should human face similar inward 1968. But monetary policy shocks don't line of piece of work organisation human relationship for whatever but a tiny purpose of output together with inflation variation, quite contra Friedman (and Taylor, together with many others') view.

Last, measure novel Keyensian DSGE models receive got potent "Fisherian" properties. In response to long lasting or expected involvement charge per unit of measurement rises, inflation goes up. More on this later.

Ellen McGrattan

Ellen stole the show. (Slides.) Take a break, together with watch the video. She manages to live hilarious together with incisive. And dissimilar the residuum of us, she didn't attempt out to sheohorn a 2 hr lecture into her xv minutes.

Her primal points. First, similar Harald, she points out that the models are driven yesteryear large shocks amongst less together with less plausible structural interpretation, together with thus farther from the Lucas critique solution than 1 time appeared to live the case. The shocks are actually "wedges," deviations from equilibrium atmospheric condition of the model amongst unknown sources

What to do? Focus on rules together with institutions. This is a deep point. Even DSGE modelers, inward the want to speak to policy makers, often adopt the static ISLM presumption that policy is nearly actions, nearly decisions, whether to heighten or lower the funds rate. The other large Lucas betoken is that nosotros should mean value nearly policy inward terms of rules together with institutions, non merely actions.

Monetary policy together with ELB

Stephanie Schmitt-Grohé (slides, video) talked nearly the Fisherian possibility -- that raising involvement rates raises inflation. New-Keynesian DSGE models, amongst rational expectations, receive got this property, especially for permanent or preannounced involvement charge per unit of measurement increases, together with when at null involvement rates or otherwise inward a passive regime where involvement rates practise non react to a greater extent than than 1 for 1 amongst inflation. She together with Martin Uribe receive got been advocating this possibility every bit a serious proposal for Europe together with Nihon that want to heighten inflation.

She presented some prissy prove that permanent increases inward involvement rates practise increment inflation -- together with correct away, non merely inward the long run.

Mike Woodford. (slides, video) gave a dense speak (37 slides, twenty minutes) on policy at the lower bound. During the ELB, primal banks moved from involvement rates to asset purchases together with forwards guidance. Mike asks,

To what extent does this hateful that the entire conceptual framework of monetary stabilization policy needs to live reconsidered, for a basis inward which ELB mightiness good move on periodically to bind?In classic form, Mike sets the interrogation upwards every bit a Ramsey problem. Given a DSGE model, what is the optimal policy, given that involvement rates are occasionally constrained? He derives from that employment a cost degree target. The cost degree target works, intuitively, yesteryear committing the primal banking concern to a menstruation of extra inflation after the null jump ends. It is a pop cast of forwards guidance. The conception hither is to derive that formally every bit an optimal policy problem.

Mike's cost degree target is stochastic, changing optimally over fourth dimension to respond to shocks. I'm a picayune skeptical that the primal banking concern tin dismiss discovery together with empathize such shocks, especially given the inward a higher house Uhlig-McGrattan give-and-take nearly the nature of shocks. Also, every bit I emphasize inward comments, I'm dubious nearly the groovy powerfulness of promises of what the primal banking concern volition practise inward the far futurity to cause output today. I'm a fan of cost degree targets, but on both sides, non merely every bit stimulus, but for utterly different reasons.

Mike takes on rather skeptically the mutual choice -- quantitative easing, asset purchases during the fourth dimension of the bound. He points out that to work, people receive got to believe that the increment inward coin is permanent, together with won't live chop-chop withdrawn when the null jump is over. As evidence, he points to Japan:

Similarly, he likes the cost degree target over forwards guidance -- speeches inward house of activity -- every bit it is a to a greater extent than credible commitment to practise things ex-post that the banking concern may non want to practise ex-post.

Finally, he addresses the puzzles of novel Keynesian models at the null jump -- forwards guidance has stronger effects the farther inward the futurity is the promise; effects acquire larger every bit prices acquire less sticky, together with so on. He argues that models should supersede rational expectations amongst a complex k-step iterated expectations rule.

Me.

Video, slides from Sweden, slides from my webpage, written version. I covered this inward a previous spider web log post, so won't repeat it all. I position a lot of endeavour inward to it, together with it summarizes a lot of what I've been doing inward xv minutes flat, so I recommend it (of course). It also offers to a greater extent than perspective on inward a higher house points yesteryear Mike together with Stephanie. My favorite line, referring to Mike's force for irrational expectations is something unopen to

"I never thought nosotros would come upwards to Sweden, that I would live defending the basic new-Keynesian program, together with that Mike Woodford would live trying to tear it down. Yet hither nosotros are. Promote the financial equation from the footnotes together with you lot tin dismiss salve the rest."Emi Nakamura

Poor Emi had to acquire terminal inward an exhausting conference of jet-lagged participants. She did a groovy chore (video, slides) roofing a century of monetary history together with monetary ideas clearly together with transparently. These are groovy slides to utilization for an undergraduate or MBA course of education on monetary policy, every bit well. An abbreviated list:

- Gold standard

- Seasonal variation inward involvement rates nether the gilded standard; coin demand shocks

- Money demand shocks inward the 1980s -- how the supposedly "stable" V inward MV=PY roughshod apart when the Fed pushed on M.

- Theoretical instability / indeterminacy of involvement charge per unit of measurement targets

- The switch to involvement charge per unit of measurement targets together with corridors inward operating procedures

- The (near-miraculous) success of inflation targets

- Taylor rules together with other theory of determinate inflation nether involvement charge per unit of measurement targets

- How is it "monetary economics" without money?

- Why did immense QE non travail inflation?

Postlude

Mon featured 2 panels, Macroeconomic inquiry together with the financial crisis: Influenza A virus subtype H5N1 critical assessment, amongst Annette Vissing-Jørgensen, Luigi Zingales, Nancy Stokey, together with Robert Barro ; and Banking together with finance inquiry together with the financial crisis: Influenza A virus subtype H5N1 critical assessment amongst Kristin Forbes, Ricardo Reis, Amir Sufi, together with Antoinette Schoar.

Perhaps it's inward the nature of panels, but I constitute these a disappointment, especially compared to the stellar presentations inward the original conference. Also I mean value it would receive got been ameliorate to allow to a greater extent than (any, really) audience questions; the whole conference was a flake disappointing for lack of full general discussion, especially amongst such a stellar group.

In particular, Luigi led yesteryear excoriating the profession for non paying attending to housing problems together with financial crises. I thought this a flake unfair together with simultaneously short-sighted. He singled out monetary economic science textbooks, including Mike Woodford's, for omitting financial crises. Well, Mike omitted asteroid impacts too. It isn't a volume about financial crises. And, after lamabasting all of us, he said non 1 tidings nearly events since 2009. What are nosotros missing now? I had to stand upwards up together with enquire that rude question, 1 time to a greater extent than suggesting that maybe nosotros are all non listening to Ken Rogoff this time. Annette went on to enquire something similar "don't you lot Chicago people believe inward whatever regulation at all," together with the respondents were every bit good polite to tell what an unproductive interrogation that is together with merely motility on.

Again, I offering apologies to authors together with discussants I didn't acquire to. The whole thing was memorable, but in that location is only so much I tin dismiss blog! Do acquire to the site together with human face at the other sessions, according to your interests.

SUBSCRIBE to Our Newsletter

Sign up here with your email address to receive updates from this blog in your inbox.

Pilih Sistem Komentar