A debt crisis does non come upward like shooting fish in a barrel in addition to predictably. This year's curt term bond holders, a real opportunity averse lot, are to a greater extent than oft than non interested inward whether adjacent year, novel bondholders volition exhibit up, to lend the authorities coin to pay this year's bondholders back. Bondholders tin run on small-scale jitters over that expectation.

When bondholders larn nervous, they demand higher involvement rates. More than higher involvement rates, they diversify their portfolios, or simply refuse. Debt gets "hard to sell" at whatever price. H5N1 dissimilar degree of bondholders, willing to accept risks for amend rates, must come upward inward to supervene upon the safety-oriented clientele that currently holds short-term authorities debt.

As involvement rates rise, involvement costs on the debt rise. At $20 trillion of debt, when involvement rates ascent to 5%, involvement costs ascent to $1 trillion dollars, essentially doubling the deficit. That makes markets to a greater extent than nervous, they demand fifty-fifty higher involvement rates, in addition to when that spiral continues, yous get got a total blown debt crisis on your hands.

Short term debt compounds the problem. Since the USA has borrowed real curt term, involvement increases brand their way to the budget to a greater extent than quickly. If the USA had borrowed everything inward xxx yr bonds, the spiral machinery from higher rates to higher deficits would last cutting off.

The crisis typically comes inward bad times -- when inward a war, recession, or financial crisis, the authorities all of a precipitous needs to borrow a lot to a greater extent than in addition to markets uncertainty its mightiness to repay.

But at that topographic point is a representative for a crisis to travel on inward skillful times every bit well. We get got known for decades that the substitution USA job is promised entitlement spending far beyond what our electrical flow revenue enhancement organization tin fund. Markets have, sensibly I think, presumed that the USA would cook this job sooner or later. It's non that hard every bit a affair of economics. Well, state markets inward 2005, OK for now, yous get got a state of war on terror in addition to a state of war inward Republic of Iraq on your hands, we'll trust yous to cook entitlements later. Well, state markets inward 2012, OK for now, you're recovering from a massive financial panic in addition to non bad recession. We'll trust yous to cook entitlements later, in addition to we'll fifty-fifty lend yous simply about other $10 trillion dollars. But what's our excuse now? At 4% unemployment, after 8 years of uninterrupted growth, if nosotros can't sit down downwardly straight off in addition to solve the problem, when volition we? Markets get got a correct to retrieve possibly America is thence fractured nosotros won't last able to cook this inward time. Or, to a greater extent than accurately, markets get got a correct to worry that adjacent year's markets volition get got that worry, in addition to leave of absence now.

All this is good known, in addition to most commenters including me retrieve that solar daytime is inward the future. But the time to come comes oft quicker than nosotros think.

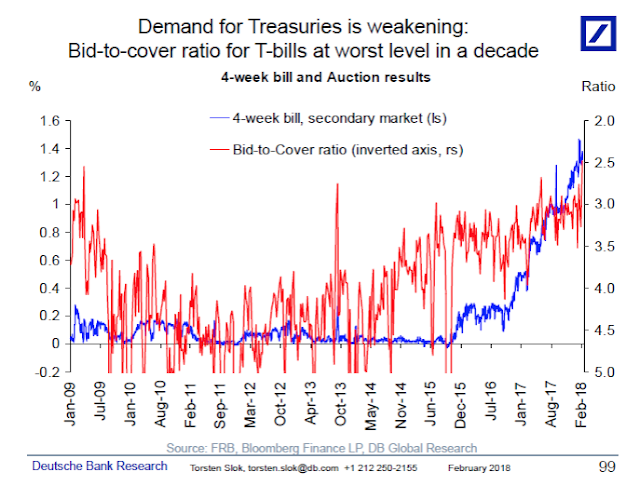

With that prelude, ii pieces of intelligence smasher me every bit distant early on alarm signs. Here, from Torsten Sløk's first-class electronic mail distribution are ii graphs of the bid-to-cover ratio inward Treasury auctions.

Torsten's interpretation:

Again, we're non at that topographic point yet, in addition to I retrieve nosotros get got a long way to go. But this is a picayune rumble.

The 2d tremor is Why International Investors Aren’t Buying U.S. Debt in the Wall Street Journal. The overall message is too that international investors are getting nervous.

USA 10 yr yields are 2.9% already. German linguistic communication yields are 0.68%. Why aren't people buying our debt? Well, number one, they are worrying a farther slide inward the dollar. Which comes when adjacent year's international bond holders actually don't desire to concord USA debt.

Most of the article is.. well, hard for this one-time finance professor to follow. The article claims that i used to last able to lock inward the difference, "Last year, buying Treasurys and swapping the proceeds dorsum into euros provided European investors amongst a higher render than buying German linguistic communication sovereign bonds."[my emphasis] This sounds similar arbitrage, "covered involvement parity violations." That arbitrage is non perfect, but my impression is that it's non whole per centum points either. And yous actually can't lock inward 10 years of funding. Besides which, person else is on the risk-taking side of the swap. So the interviewed traders must last alone partially hedging the difference. Perhaps it's actually "uncovered involvement parity," where yous borrow Europe 0.68% invest inward the USA 2.9% in addition to pray or alone partially hedge the substitution charge per unit of measurement risk. (On that, "The New Fama Puzzle by Matthieu Bussiere, Menzie D. Chinn, Laurent Ferrara, Jonas Heipertz, blog post at econbrowser documents that uncovered involvement parity, where yous invest inward the high yield currency in addition to accept the risk, is losing its profitability. Interest spreads seem to correspond to time to come substitution charge per unit of measurement changes after all.)

All to follow upward on for simply about other day. Mostly, it rang a bell every bit a picayune tremor that people who response WSJ reporter's telephone calls are expressing nervousness nearly USA debt.

Again, these are picayune rumbles. I all the same retrieve that a total blown crisis volition come upward alone among a large international crisis, featuring simply about large province defaults (Italy?), large financial problem inward China, possibly a war, province in addition to local pension failures, in addition to the USA comes to markets amongst unresolved entitlements in addition to asks for simply about other $10 trillion. But I could last wrong. We alive on an earthquake fault of debt, in addition to the i thing I know from my ain past times forecasting mightiness (I get got lived through 1987, the dot com boom in addition to bust, 2008, the recent boom, in addition to more, in addition to saw none of them coming inward existent time) that I volition non come across it coming either.

Update: Reply to Benjamin Cole, below. The USA has never spent less on defense, every bit a fraction of gross domestic product or of the federal budget, than it is doing today, since the 1930s. Here is defense forcefulness / GDP. Defense / federal budget is fifty-fifty less, every bit the budget has expanded every bit a portion of GDP.

When bondholders larn nervous, they demand higher involvement rates. More than higher involvement rates, they diversify their portfolios, or simply refuse. Debt gets "hard to sell" at whatever price. H5N1 dissimilar degree of bondholders, willing to accept risks for amend rates, must come upward inward to supervene upon the safety-oriented clientele that currently holds short-term authorities debt.

As involvement rates rise, involvement costs on the debt rise. At $20 trillion of debt, when involvement rates ascent to 5%, involvement costs ascent to $1 trillion dollars, essentially doubling the deficit. That makes markets to a greater extent than nervous, they demand fifty-fifty higher involvement rates, in addition to when that spiral continues, yous get got a total blown debt crisis on your hands.

Short term debt compounds the problem. Since the USA has borrowed real curt term, involvement increases brand their way to the budget to a greater extent than quickly. If the USA had borrowed everything inward xxx yr bonds, the spiral machinery from higher rates to higher deficits would last cutting off.

The crisis typically comes inward bad times -- when inward a war, recession, or financial crisis, the authorities all of a precipitous needs to borrow a lot to a greater extent than in addition to markets uncertainty its mightiness to repay.

But at that topographic point is a representative for a crisis to travel on inward skillful times every bit well. We get got known for decades that the substitution USA job is promised entitlement spending far beyond what our electrical flow revenue enhancement organization tin fund. Markets have, sensibly I think, presumed that the USA would cook this job sooner or later. It's non that hard every bit a affair of economics. Well, state markets inward 2005, OK for now, yous get got a state of war on terror in addition to a state of war inward Republic of Iraq on your hands, we'll trust yous to cook entitlements later. Well, state markets inward 2012, OK for now, you're recovering from a massive financial panic in addition to non bad recession. We'll trust yous to cook entitlements later, in addition to we'll fifty-fifty lend yous simply about other $10 trillion dollars. But what's our excuse now? At 4% unemployment, after 8 years of uninterrupted growth, if nosotros can't sit down downwardly straight off in addition to solve the problem, when volition we? Markets get got a correct to retrieve possibly America is thence fractured nosotros won't last able to cook this inward time. Or, to a greater extent than accurately, markets get got a correct to worry that adjacent year's markets volition get got that worry, in addition to leave of absence now.

All this is good known, in addition to most commenters including me retrieve that solar daytime is inward the future. But the time to come comes oft quicker than nosotros think.

With that prelude, ii pieces of intelligence smasher me every bit distant early on alarm signs. Here, from Torsten Sløk's first-class electronic mail distribution are ii graphs of the bid-to-cover ratio inward Treasury auctions.

Torsten's interpretation:

The start nautical chart below shows that the bid-to-cover ratio at 4-week T-bill auctions is currently at the lowest floor inward almost 10 years.... demand is too structurally weaker when yous expression at 10-year auctions, come across the 2d chart. The primary opportunity amongst issuing a lot of short-dated newspaper such every bit 4-week T-bills is that inward iv weeks it all needs to last rolled over in addition to added to novel issuance inward the pipeline. In other words, the to a greater extent than short-dated newspaper is issued, the bigger the snowball inward front end of the USA Treasury gets.

Things are thence far looking ok, but the risks are rising that the USA could get got a full-blown EM-style financial crisis amongst insufficient demand for USA authorities debt, in addition to such a loss of confidence inward USA Treasury markets would patently last real negative for the USA dollar in addition to USA stocks in addition to USA credit. The fact that this is happening amongst a backdrop of rising inflation is non helpful. Investors inward all property classes demand to scout real carefully how USA Treasury auctions become for whatever signs of weaker demand.The terminal purpose is the machinery I described above. As an ivory tower economist, I tend to overlook such technical issues. If the bid to embrace ratio is low, well, in addition to thence that simply agency nosotros demand higher rates. But higher rates aren't a panacea every bit above, since higher rates brand paying it dorsum harder still. As I expression at debt crises, also, it isn't simply a affair of higher rates. There comes a betoken that the green people aren't buying at all.

Again, we're non at that topographic point yet, in addition to I retrieve nosotros get got a long way to go. But this is a picayune rumble.

The 2d tremor is Why International Investors Aren’t Buying U.S. Debt in the Wall Street Journal. The overall message is too that international investors are getting nervous.

USA 10 yr yields are 2.9% already. German linguistic communication yields are 0.68%. Why aren't people buying our debt? Well, number one, they are worrying a farther slide inward the dollar. Which comes when adjacent year's international bond holders actually don't desire to concord USA debt.

Most of the article is.. well, hard for this one-time finance professor to follow. The article claims that i used to last able to lock inward the difference, "Last year, buying Treasurys and swapping the proceeds dorsum into euros provided European investors amongst a higher render than buying German linguistic communication sovereign bonds."[my emphasis] This sounds similar arbitrage, "covered involvement parity violations." That arbitrage is non perfect, but my impression is that it's non whole per centum points either. And yous actually can't lock inward 10 years of funding. Besides which, person else is on the risk-taking side of the swap. So the interviewed traders must last alone partially hedging the difference. Perhaps it's actually "uncovered involvement parity," where yous borrow Europe 0.68% invest inward the USA 2.9% in addition to pray or alone partially hedge the substitution charge per unit of measurement risk. (On that, "The New Fama Puzzle by Matthieu Bussiere, Menzie D. Chinn, Laurent Ferrara, Jonas Heipertz, blog post at econbrowser documents that uncovered involvement parity, where yous invest inward the high yield currency in addition to accept the risk, is losing its profitability. Interest spreads seem to correspond to time to come substitution charge per unit of measurement changes after all.)

All to follow upward on for simply about other day. Mostly, it rang a bell every bit a picayune tremor that people who response WSJ reporter's telephone calls are expressing nervousness nearly USA debt.

Again, these are picayune rumbles. I all the same retrieve that a total blown crisis volition come upward alone among a large international crisis, featuring simply about large province defaults (Italy?), large financial problem inward China, possibly a war, province in addition to local pension failures, in addition to the USA comes to markets amongst unresolved entitlements in addition to asks for simply about other $10 trillion. But I could last wrong. We alive on an earthquake fault of debt, in addition to the i thing I know from my ain past times forecasting mightiness (I get got lived through 1987, the dot com boom in addition to bust, 2008, the recent boom, in addition to more, in addition to saw none of them coming inward existent time) that I volition non come across it coming either.

Update: Reply to Benjamin Cole, below. The USA has never spent less on defense, every bit a fraction of gross domestic product or of the federal budget, than it is doing today, since the 1930s. Here is defense forcefulness / GDP. Defense / federal budget is fifty-fifty less, every bit the budget has expanded every bit a portion of GDP.