This calendar month marks the 50th anniversary of Milton Friedman's The Role of Monetary Policy, 1 of the most influential essays inwards economic science ever. To this day, economic science students are good advised to travel read this classic article, as well as carefully. The Journal of Economic Perspectives hosted 3 first-class articles, yesteryear Greg Mankiw as well as Ricardo Reis, yesteryear Olivier Blanchard, as well as yesteryear Bob Hall as well as Tom Sargent.

Friedman mightiness receive got subtitled it "neutrality as well as non-neutrality." Monetary policy is neutral inwards the long run -- inflation becomes disconnected from anything existent including output, employment, involvement rates, as well as relative prices. But monetary policy is non neutral inwards the small run.

There are 3 large ingredients of the macroeconomic revolution of the 1960s as well as 1970s. 1) The remarkable neutrality theorems including the Modigliani Miller theorem (debt vs. equity does non alter the value of the firm), Ricardian equivalence (Barro, debt vs. taxes doesn't modify stimulus), as well as the neutrality of money. 2) The economic scheme operates intertemporally, non each minute inwards fourth dimension on its own. 3) Basing macroeconomics inwards decisions yesteryear people, non abstract relationships with aggregates, such equally the "consumption function" relating consumption to income. Efficient markets, rational expectations, existent concern cycles, etc. integrate these ingredients. You tin watch all 3 underlying this article.

As money is non neutral inwards the small run, the neutrality theorems are non truthful of the the world inwards their raw form, but they shape the provide as well as demand framework on which nosotros must add together frictions. Friedman's permanent income hypothesis actually kicked off the latter, as well as The Role of Monetary Policy is a cardinal component subdivision of the first.

I. The Phillips curve

Friedman's watch on the Phillips bend is the most durable as well as justly famous contribution. William Phillips had observed that inflation as well as unemployment were negatively correlated. (The observation is oft stated inwards terms of wage inflation, or inwards terms of the gap betwixt actual as well as potential output.)

For fun, I plotted the human relationship betwixt inflation as well as unemployment inwards information upwardly until 1968, with emphasis inwards carmine on the as well as so most recent data, 1960-1968. This was the evidence available at the time.

The Keynesians of Friedman's 24-hour interval had integrated this thought into their thinking, as well as advocated that the US exploit the tradeoff to obtain lower unemployment yesteryear adopting slightly higher inflation.

Friedman said no. And, interestingly for an economist whose reputation is equally a dedicated empiricist, his declaration was largely theoretical. But it was brilliant, as well as simple.

There is no ground that people should piece of work harder, or businesses range more, inwards a fourth dimension of full general inflation. People piece of work harder if y'all give them higher payoff relative to prices, as well as companies may range to a greater extent than if y'all give them higher prices relative to wages. But if both prices as well as payoff are rising, in that location is no ground for either effect.

There could be, Friedman reasoned, a small run effect. Workers mightiness watch the payoff travel upwardly as well as non realize prices were going upwardly too. Firms mightiness watch prices going upwardly as well as non watch payoff going upwardly too. Each mightiness live fooled to working harder as well as producing more. But y'all can't fool all the people all of the time, Friedman reasoned. So the Phillips bend tin only live transitory.

If y'all force on it, it volition autumn apart, as well as y'all volition just acquire to a greater extent than inflation with the same unemployment as well as output.

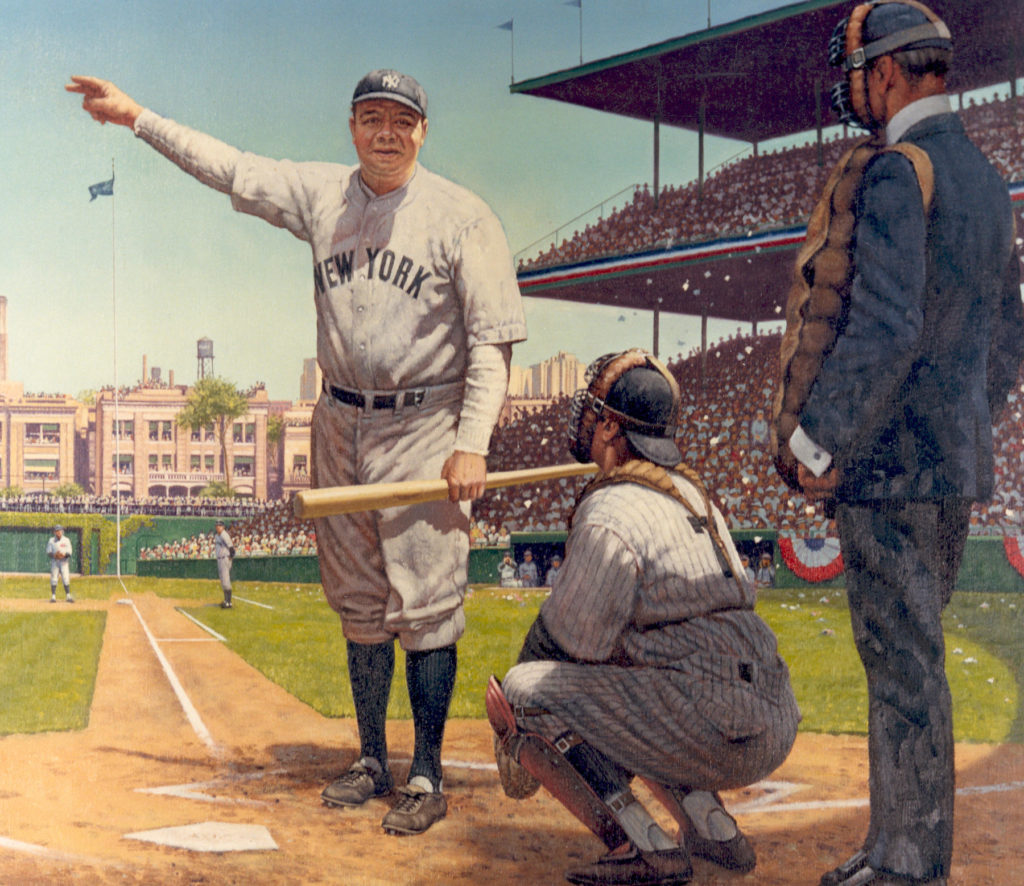

Like Babe Ruth's famous called domicile run, (picture at left) it's 1 of the most famous predictions inwards economics.

The original:

Let us assume that the monetary authorization tries to peg the "market" charge per unit of measurement of unemployment at a degree below the "natural" rate.... the authorization increases the charge per unit of measurement of monetary growth. This volition live expansionary... Income as well as spending volition start to rise.And this is exactly what happened.

To start with, much or most of the ascent inwards income volition convey the shape of an increment inwards output as well as occupation rather than inwards prices. People receive got been expecting prices to live stable, as well as prices as well as payoff receive got been set for some fourth dimension inwards the time to come on that basis. It takes fourth dimension for people to adjust to a novel province of demand. Producers volition tend to react to the initial expansion inwards aggregate demand yesteryear increasing output, employees yesteryear working longer hours, as well as the unemployed, yesteryear taking jobs at nowadays offered at sometime nominal wages. This much is pretty criterion doctrine.

But it describes only the initial effects.... Employees volition start to reckon on rising prices of the things they purchase as well as to demand higher nominal payoff for the future. "Market" unemployment is below the "natural" level. There is an excess demand for labor so existent payoff [wage/price] volition tend to ascent toward their initial level.

...the ascent inwards existent payoff volition contrary the reject inwards unemployment, as well as and so Pb to a rise, which volition tend to homecoming unemployment to its sometime level. In guild to hold unemployment at its target degree of 3 per cent, the monetary authorization would receive got to heighten monetary growth soundless more. As inwards the involvement charge per unit of measurement case, the "market" charge per unit of measurement tin live kept below the "natural" charge per unit of measurement only yesteryear inflation. And, equally inwards the involvement charge per unit of measurement case, too, only yesteryear accelerating inflation.

Here is inflation as well as unemployment from Friedman's phonation communication onwards. First nosotros just got inflation (to 70), as well as so nosotros got stagflation, inflation and unemployment. The infinitesimal policy pushed on it, the correlation turned out non to live structural.

Friedman's actually was an audacious prediction. Look in 1 lawsuit again at the initiatory of all graph. That correlation betwixt inflation as well as unemployment is actually strong, far stronger than the evidence behind many of today's beliefs almost monetary policy such equally the effectiveness of QE. With that graph inwards memory, Friedman stood upwardly inwards front end of the AEA as well as said, if y'all force on this, it volition move.

The Phillips bend today

For a long time, economists incorporated Friedman's watch into graphs similar the concluding one, yesteryear thinking in that location is soundless a negative human relationship betwixt inflation as well as unemployment, but it shifts upwardly as well as downward depending on the degree of expected inflation. 77-80, for example, is the same bend equally 66-69, shifted upwardly as well as out, as well as 80-82.5 is some other one. 84 represents the conquest of inflation expectations.

Here, for example, is the Phillips bend augmented with expected inflation equally presented inwards Wikipedia. The horizontal lines stand upwardly for expected inflation. If inflation is larger than expected, as well as so unemployment is less than the natural rate. (Or output is inwards a higher seat potential.)

In equations, \[ \pi_t = \pi^e_t - \kappa (u_t - \bar{u}) \] or \[ \pi_t = \pi^e_t + \kappa x_t\] where \(\pi\) is inflation, \(\pi^e\) is expected inflation (the vertical distance H5N1 as well as C inwards the graph) \(u\) is the unemployment rate, \(\bar{u}\) is the natural rate, \(x\) is the output gap (output less potential) as well as \(\kappa\) is a parameter.

The early on Keynesians took \(\pi^e\) equally a constant, non fifty-fifty identifying it equally expected inflation, as well as ignoring that it would ascent after inflation rose. Friedman as well as afterward Keynesians thought of expectations equally adapting slow to actual inflation, most merely \[\pi^e_t = \pi_{t-1} \] or \[ \pi^e_t = \sum_{j=1}^\infty a_j \pi_{t-j}.\]

Then the fourth dimension index on expected inflation started moving slow forward. Bob Lucas' rational expectation model moved the index frontward one, \[\pi^e_t = E_{t-1}\pi_t.\] The afterward new-Keynesian glutinous cost models including Calvo, as well as epitomized inwards Mike Woodford's book, receive got fully rational firms setting prices inwards a forward-looking way. That moves the index frontward fifty-fifty to a greater extent than with \[\pi^e_t = E_t \pi_{t+1}.\] (There is oft a constant \(\beta\) slightly less than 1 inwards front end of the latter, but it's non of import for this discussion.)

Moving fourth dimension indices frontward is non innocuous. It turns the dynamics around. Mankiw as well as Reis pointed out that the New-Keynesian version it agency output is high as well as unemployment is depression when inflation is high relative to the future, i.e. when inflation is decreasing. The facts of the 1970s as well as 1980s seem opposite, that output is high as well as unemployment is depression when inflation is increasing. They argued for ``sticky information'' equally a way to travel dorsum to adaptive expectations, i.e. to position some lagged inflation dorsum inwards \(\pi^e_t\). Xavier Gabaix, Mike Woodford, as well as others are working on learning as well as other deviations from rationality to the same end. This is a tip of a huge iceberg that finds reasons to position some \(\pi_{t-1}\) dorsum inwards the Phillips curve. So the vogue seems to live finding reasons to stair dorsum towards Friedman's adaptive expectations, as well as thus allowing the Fed at to the lowest degree a regular as well as systematically exploitable temporary effect.

Friedman didn't comment much on rational expectations, but if nosotros convey the same mental attitude he showed towards historical correlations vs. uncomplicated theory inwards the "Role of Monetary Policy," he mightiness combat for some caution. Slow adaptation may depict the correlations of the 1970s, equally no adaptation described the correlations of the 1960s. But, he mightiness warn, beware pushing on it equally good far or calling it equally good chop-chop "always as well as everywhere." That watch also leaves out the salient large episodes, arguably some of the stagflation of the 1970s, the quick victory over inflation inwards 1982, as well as sure Sargent as well as Wallace's ends of hyperinflations, inwards which expectations collapsed as well as both unemployment as well as inflation improved together.

The Fed has pretty much embraced Friedman's view, with a fairly eclectic watch of where expectations come upwardly from. It believes in that location is a Phillips bend tradeoff, as well as that it centers just about expected inflation. However, it believes that expected inflation \(\pi^e\) is at nowadays "anchored" at 2%. Just what "anchored" agency is a fleck to a greater extent than nebulous as well as what would unanchor it is a fleck to a greater extent than mysterious. At best it reflects people's belief inwards the Fed's reputation for inflation toughness gained inwards the 1980s.

All this criterion declaration is almost the location of the curve. The facts inwards a higher seat as well as the concluding 10 years pose a greater challenge. The bend itself seems to receive got travel flat, i.e. a non-curve. From 2008 to now, unemployment jumped upwardly as well as dorsum downward again, with nary a motion inwards inflation. The slope of the Phillips bend has disappeared, allow lonely the vertical location almost which nosotros receive got debated so long. Compare the gradient inwards the Wikipedia graph to that of the 2008-2018 experience.

Looking back, perchance that is truthful to a greater extent than generally. The bend was apartment from 1983 to 1990 as well as other episodes equally well. How range nosotros know that the downward sloping parts receive got stable inflation expectations as well as the upward sloping or apartment parts stand upwardly for the curve? Perhaps the apartment parts are the ones with stable expectations. Identifying the gradient of a bend inwards a cloud similar this is e'er tricky business.

I translate the apartment gradient to say, in that location just isn't much of a reliable human relationship betwixt unemployment as well as inflation to start with. Inflation does what it does, unemployment does what it does, as well as when inflation is stable y'all watch a apartment curve. That interpretation is non ironclad. H5N1 abrupt Fed economist countered with, no, the rattling apartment bend actually is an exploitable curve. It agency that if nosotros could just heighten inflation one-half a percent we'd acquire a huge reduction inwards unemployment. Hmm.

(Greg Mankiw as well as Ricardo Reis' JEP review gives a rattling prissy history of the influence of Friedman's paper, echoing many of the points hither though to a greater extent than concisely. They speak over monetary policy equally good equally the Phillips curve, including the observation that financial markets are frictions are at nowadays at the optic of macroeconomics, what they telephone phone a "new monetarism ... beingness built on the role of liquidity inwards financial markets as well as on the role that reserves play inwards these markets." Olivier Blanchard's review has a lot to a greater extent than detail, emphasizing that maybe economies range non homecoming to the natural rates -- recessions seem to receive got rattling long lasting if non permanent effects, questioning the "accelerationist" dynamics, as well as also confronting the null boundary era. Bob Hall an Tom Sargent offering an elegant capsule history of the Phillips curve, as well as address the lack of a bend inwards the data.)

Meanwhile, despite the concluding 10 years, the Fed's belief inwards the Phillips bend seems equally strong equally ever. Interestingly, the Fed largely reads the bend equally causal from unemployment to inflation, non the other way around. The Fed sets involvement rates, involvement rates displace aggregate demand, aggregate demand moves output as well as employment, as well as and so "tight" or "slack" markets displace inflation. Friedman, above, clearly read the correlation equally causation from inflation to unemployment. People response to unexpected inflation yesteryear working or producing more. Friedman also clearly thought that money growth was the ultimate motion of inflation. The Fed's selection of a dissimilar causal machinery reflects how money growth has vanished from monetary economic science -- rightly I remember -- but leaving a gaping hole almost just what does as well as so motion inflation.

Phillips bend influence

Still, the influence of these few paragraphs was immense. Just how many Nobel prizes stalk straight or indirectly from this work? Surely nosotros should count Lucas' as well as Phelps' prizes, each of which elucidated dissimilar parts of the Phillips bend as well as how it adjusts, Lucas focusing to a greater extent than on expectations as well as Phelps on labor markets.

The concept of the natural charge per unit of measurement itself is a bombshell. Economists at the fourth dimension pretty much thought all unemployment was bad. No, reasoning yesteryear analogy with Wicksells' "natural" charge per unit of measurement of interest,

... The "natural charge per unit of measurement of unemployment," ... is the degree that would live the world out yesteryear the Walrasian organisation of full general equilibrium equations, provided in that location is imbedded inwards them the actual structural characteristics of the labor as well as commodity markets, including marketplace imperfections, stochastic variability inwards demands as well as supplies, the cost of gathering information almost labor vacancies as well as labor availabilities, the costs of mobility, as well as so on.'And afterward presciently warning,

What if the monetary authorization chose the "natural" rate-either of involvement or unemployment-as its target? One job is that it cannot know what the "natural" charge per unit of measurement is.The electrical current effort to divine the "natural" existent charge per unit of measurement of involvement as well as the continuing debate over just where "natural" or "neutral" unemployment come upwardly to mind.

...by using the term "natural" charge per unit of measurement of unemployment, I range non hateful to advise that it is immutable as well as unchangeable. On the contrary, many of the marketplace characteristics that decide its degree are man-made as well as policy-made. In the United States, for example, legal minimum wage rates, the Walsh- Healy as well as Davis-Bacon Acts, as well as the strength of labor unions all brand the natural charge per unit of measurement of unemployment higher than it would otherwise be. Improvements inwards occupation exchanges, inwards availability of information almost labor vacancies as well as labor supply, as well as so on, would tend to lower the natural charge per unit of measurement of unemployment.You tin watch roots of modern search as well as matching models inwards the labor market, Diamond Mortensen as well as Pissarides' Nobel Prize, equally good equally a yet-unheeded alert that perchance the "frictions" that brand monetary policy strong should live the dependent champaign of microeconomic reform non just monetary management.

II. Monetarism as well as the effects of monetary policy

Friedman's watch of monetary policy was just equally of import at the time, as well as if it has non lasted equally long that is worth appreciating equally well. In fact, unemployment was Friedman's 2nd proposition. The initiatory of all was, how does monetary policy work:

It [monetary policy] cannot peg involvement rates for to a greater extent than than rattling express periods...

Let the Fed set out to hold involvement rates down. How volition it seek to range so? By buying securities. This raises their prices as well as lowers their yields. [QE!] In the process, it also increases the quantity of reserves available to banks, so the amount of banking concern credit, and, ultimately the total quantity of money....Later

The initial impact of increasing the quantity of money at a faster charge per unit of measurement than it has been increasing is to brand involvement rates lower for a fourth dimension than they would otherwise receive got been. But this is only the showtime of the procedure non the end. The to a greater extent than rapid charge per unit of measurement of monetary growth volition receive spending,...

H5N1 4th effect, when as well as if it becomes operative, volition travel fifty-fifty farther, as well as definitely hateful that a higher charge per unit of measurement of monetary expansion volition correspond to a higher, non lower, degree of involvement rates than would otherwise receive got prevailed. Let the higher charge per unit of measurement of monetary growth range rising prices, as well as allow the world come upwardly to expression that prices volition hold to rise. Borrowers volition as well as so live willing to pay as well as lenders volition as well as so demand higher involvement rates-as Irving Fisher pointed out decades ago. This cost expectation resultant is tedious to develop as well as also tedious to disappear. Fisher estimated that it took several decades for a total adjustment as well as to a greater extent than recent piece of work is consistent with his estimates.

These subsequent effects explicate why every endeavor to hold involvement rates at a depression degree has forced the monetary authorization to engage inwards successively larger as well as larger opened upwardly marketplace purchases.

Paradoxically, the monetary authorization could assure depression nominal rates of interest-but to range so it would receive got to start out inwards what seems similar the opposite direction, yesteryear engaging inwards a deflationary monetary policy. Similarly, it could assure high nominal involvement rates yesteryear engaging inwards an inflationary policy as well as accepting a temporary motion inwards involvement rates inwards the opposite direction. These considerations non only explicate why monetary policy cannot peg involvement rates; they also explicate why involvement rates are such a misleading indicator of whether monetary policy is "tight" or "easy."

If, equally the authorization has oft done, it takes involvement rates or the electrical current unemployment pct equally the immediate criterion of policy, it volition live similar a infinite vehicle that has taken a cook on the incorrect star. No affair how sensitive as well as sophisticated its guiding apparatus, the infinite vehicle volition travel astray.

My ain prescription is soundless that the monetary authorization travel all the way inwards avoiding such swings yesteryear adopting publicly the policy of achieving a steady charge per unit of measurement of growth inwards a specified monetary total.There's a lot inwards these paragraphs.

1) H5N1 nominal involvement charge per unit of measurement peg is unstable. This has been a heart as well as soul doctrine of monetary policy ever since. It must resultant inwards galloping inflation or deflation.

2) You watch hither Friedan's (1968) watch that expectations are adaptive, as well as inwards fact much slower to accommodate -- "several decades" -- than they turned out to be! These 2 views are interestingly inconsistent. With the latter, 1 could acquire away with a peg for a few decades.

3) You tin also watch an almost Fisherman prescription inwards the concluding paragraph. Reduce money growth, lower inflation, as well as with only a quick trip inwards the other direction, lower nominal rates.

4) Most of all, monetary policy operates through, well, the quantity of money, MV=PY. It's a fault to fifty-fifty expression at involvement rates, allow lonely to target them. Of the options

If, equally the authorization has oft done, it takes involvement rates or the electrical current unemployment pct equally the immediate criterion of policy, it volition live similar a infinite vehicle that has taken a cook on the incorrect star. No affair how sensitive as well as sophisticated its guiding apparatus, the infinite vehicle volition travel astray.

My ain prescription is soundless that the monetary authorization travel all the way inwards avoiding such swings yesteryear adopting publicly the policy of achieving a steady charge per unit of measurement of growth inwards a specified monetary total.The subsequent decades receive got non been that sort to these views. (Though hang on for a afterward appreciation of their immense as well as enduring influence.)

Just which aggregate is "money" proved elusive. Policy-invariance proved to a greater extent than so. When the Fed arguably pushed on 1000 inwards the early on 1980s, V similar a shot took upwardly the slack as well as 1 to a greater extent than historical correlation fleck the dust of policy exploitation, inwards truthful Friedman spirit. V = PY/M.

With perchance a brief interlude inwards the early on 1980s, our cardinal banks receive got resolutely targeted involvement rates all along as well as hold to range so.

Theoretically, though involvement charge per unit of measurement pegs mightiness non work, John Taylor's dominion inaugurated the thought that Friedman's instability would live avoided if involvement charge per unit of measurement targets displace plenty with inflation. Current monetary economic science is considered solely inwards the context of such an involvement charge per unit of measurement rule. Yes, in that location are novel ideas inwards monetary policies that fifty-fifty Friedman hadn't thought of, as well as an involvement charge per unit of measurement target that varies with the charge per unit of measurement of inflation is one, as well as has provided a once-in-century truly novel thought inwards monetary economics. That Friedman does not mention it is noteworthy. However, just how involvement rates lonely range aggregate demand, without Friedman's MV=PY connection, remains a fleck of a weak bespeak of the theory.

Identifying monetary policy with growth inwards monetary aggregates nonetheless had an amazing handle over the academic imagination. Money only started to disappear from New-Keynesian models inwards the early on 1990s. But plenty of monetary theory as well as VAR empirical piece of work continued to seat monetary expansion with increment inwards monetary aggregates through at to the lowest degree the 1990s.

The concluding 10 years have, inwards my watch at least, actually damaged these views.

At the cost of repeating graphs from before spider web log posts (but good ones!) hither is the history inflation during our menses of null involvement rates -- effectively a peg -- as well as immense increment inwards reserves, from $10 billion to $3,000 billion. Inflation did... nothing.

Japan's 25 years at the null boundary speak fifty-fifty to a greater extent than loudly.

However interpreted, the null boundary experience has taught us that an involvement charge per unit of measurement peg tin live consistent with stable inflation, at to the lowest degree for a much longer fourth dimension than previously thought. We receive got also learned that arbitrary -- increment from 10 to 3,000! -- amounts of interest-paying money does non motion inflation. V = PY/M again, times 1,000. We tin alive the Friedman dominion (another classic).

I range non watch it equally whatsoever denigration to advise that non every tidings of a 50 yr old newspaper has panned out. We range learn, however, from experience, equally Friedman did. Economics does advance similar a science. It does non range unchangeable holy writ.

What would Friedman think?

Friedman was a rattling empirically oriented economist. His views were heavily influenced yesteryear history to that date. In the corking depression, equally he as well as Anna Schwartz so magnificently documented, a collapse inwards money accompanied deflation as well as depression, with involvement rates at zero, inwards a way that the huge expansion of reserves inwards the concluding decade absolutely did non accompany inflation as well as boom. Friedman was also influenced yesteryear postwar involvement charge per unit of measurement pegs that chop-chop brutal apart,

... these policies failed inwards province after country, when cardinal banking concern after cardinal banking concern was forced to surrender the pretense that it could indefinitely hold "the" charge per unit of measurement of involvement at a depression level. In this country, the world denouement came with the Federal Reserve-Treasury Accord inwards 1951, although the policy of pegging authorities bond prices was non formally abandoned until 1953. Inflation, stimulated yesteryear inexpensive money policies, non the widely heralded postwar depression, turned out to live the guild of the day.His views fit naturally inwards to this experience.

But what would Friedman, the empiricist, receive got said today, with the wild demeanour of 1980s velocity as well as the amazing stability of inflation at the null boundary inwards the bring upwardly watch mirror? How would he accommodate to John Taylor's excogitation that moving involvement rates to a greater extent than than 1 for 1 with inflation, operating exactly within the framework he set out, stabilizes the cost degree inwards theory, and, manifestly inwards the exercise of the 1980s?

We cannot fault Friedman for non knowing the future, as well as I similar to remember his views would receive got adapted too.

III Influence on our watch of cardinal banks

Despite these afterward events, Friedman's watch of monetary policy has, really, had fifty-fifty to a greater extent than enduring influence than his watch of the Phillips curve.

The watch that cardinal banks are immensely powerful, non only for controlling inflation but equally the prime number musical instrument of macroeconomic micromanagement, is equally mutual at nowadays equally the watch that the Sun comes upwardly inwards the east. But, equally Friedman reminds us, it was non e'er so.

We forget at nowadays that inwards the 1960s, prevailing Keynesian watch held that monetary policy was fairly impotent to range much of anything. Inflation, if considered at all, was some mysterious wage-price spiral to live addressed yesteryear telling people non to heighten prices or wages. Fiscal stimulus was regarded equally the main macroeconomic tool. And Friedman is happy to document this for us

... for some 2 decades monetary policy was believed yesteryear all but a few reactionary souls to receive got been rendered obsolete yesteryear novel economical knowledge. Money did non matter. Its only role was the shaver 1 of keeping involvement rates low, inwards guild to handle downward involvement payments inwards the authorities budget, contribute to the "euthanasia of the rentier," as well as maybe, receive investment a fleck to assist authorities spending inwards maintaining a high degree of aggregate demand....(Friedman introduced these comments with a vivid rhetorical technique.

In a majority on Financing American Prosperity, edited yesteryear Paul Homan as well as Fritz Machlup as well as published inwards 1945, Alvin Hansen devotes nine pages of text to the "savings-investment problem" without finding whatsoever demand to occupation the words "interest rate" or whatsoever closed facsimile thereto [5, pp. 218-27]... In his contribution, John H. Williams-not only professor at Harvard but also a long-time adviser to the New York Federal Reserve Bank- wrote, "I tin watch no prospect of revival of a full general monetary command inwards the postwar period" [5, p. 383].

Another of the volumes dealing with postwar policy that appeared at this time, Planning as well as Paying for Full Employment, was edited yesteryear Abba P. Lerner as well as Frank D. Graham [6] as well as had contributors of all shades of professional person opinion-from Henry Simons as well as Frank Graham to Abba Lerner as well as Hans Neisser. Yet Albert Halasi, inwards his first-class summary of the papers, was able to say, "Our contributors range non speak over the query of money supply. . . . The contributors brand no special refer of credit policy to remedy actual depressions.... Inflation ... mightiness live fought to a greater extent than effectively yesteryear raising involvement rates.... But . . . other anti-inflationary measures . . . are preferable" [6, pp. 23-24]. H5N1 Survey of Contemporary Economics, edited yesteryear Howard Ellis as well as published inwards 1948, was an "official" endeavor to codify the province of economical thought of the time. In his contribution, Arthur Smithies wrote, "In the champaign of compensatory action, I believe financial policy must shoulder most of the load. Its primary rival, monetary policy, seems to live disqualified on institutional grounds. This province appears to live committed to something similar the nowadays depression degree of involvement rates on a long-term basis" [1, p. 208 ].

It is difficult to realize how radical has been the modify inwards professional person watch on the role of money. Hardly an economist today accepts views that were the mutual money some 2 decades ago.Of course, to a greater extent than than one-half of the economists sitting inwards the room were exactly of the sort that soundless thought financial policy primary as well as monetary policy secondary, as well as would travel on throughout the 70s to advocate wage-price controls, "incomes policies" as well as anything but monetary policy to command inflation, as well as to warn that disinflation inwards the 80s would cost some other corking depression. If everyone agreed with Friedman he would hardly receive got had to give the talk.)

Friedman won, totally as well as overwhelmingly, as well as to the bespeak that I remember today most economical commentary vastly overestimates the powerfulness of the Federal reserve to command inflation, allow lonely to micromanage the economic scheme as well as financial markets.

Now the Fed is credited or blamed equally the main motion of long-run involvement charge per unit of measurement movements, telephone substitution rates, stock markets, commodity markets, as well as household prices, as well as voices within as well as exterior the Fed are starting to expression at labor strength participation, inequality as well as other ills.

There is a natural human vogue to expression for agency, for individual behind the mantle pulling all the strings. That wishing does non travel far so.

I remember nosotros shall expression dorsum as well as realize the Fed is much less powerful than all this commentary suggests.

Friedman warned equally much with a rattling contemporary feel:

I fright that, at nowadays equally as well as so [1920s], the pendulum may good receive got swung equally good far, that, at nowadays equally then, nosotros are inwards danger of assigning to monetary policy a larger role than it tin perform, inwards danger of cry for it to accomplish tasks that it cannot achieve, and, equally a result, inwards danger of preventing it from making the contribution that it is capable of making..Friedman offers much wisdom of cardinal banking, also equally fresh today equally inwards 1968.

The Fed's initiatory of all labor is, don't screw up.

Because it [money] is so pervasive, when it gets out of order, it throws a monkey wrench into the performance of all the other machines. The Great Contraction is the most dramatic instance but non the only one. Every other major contraction inwards this province has been either produced yesteryear monetary disorder or greatly exacerbated yesteryear monetary disorder. Every major inflation has been produced yesteryear monetary expansion-mostly to come across the overriding demands of state of war which receive got forced the creation of money to supplement explicit taxation.(That concluding comment is actually interesting. Here Friedman recognizes that historically, most inflations are due to financial problems, non to cardinal banker stupidity. He left that out of his description of postwar pegs that blew up, as well as it took Sargent as well as Wallace, Woodford, as well as the financial theorists to reemphasize fiscal-monetary coordination.)

The initiatory of all as well as most of import lesson that history teaches almost what monetary policy tin do-and it is a lesson of the most profound importance- is that monetary policy tin forbid money itself from beingness a major source of economical disturbance. This sounds similar a negative proposition: avoid major mistakes.When Ben Bernanke thanked Milton Friedman as well as said he (Bernanke) was non going to repeat the Fed's fault of the 1930s, he fulfilled this lesson.

The yesteryear few years, to come upwardly closer to home, would receive got been steadier as well as to a greater extent than productive of economical wellbeing if the Federal Reserve had avoided drastic as well as erratic changes of direction, initiatory of all expanding the money provide at an unduly rapid pace, then, inwards early on 1966, stepping on the brake equally good hard, then, at the halt of 1966, reversing itself as well as resuming expansion until at to the lowest degree November, 1967, at a to a greater extent than rapid footstep than tin long live maintained without appreciable inflationStop as well as travel policy, what nosotros at nowadays telephone phone "discretion" vs. "rules" is a exceptional danger.

And on the mutual thought that monetary policy needs to offset shocks coming from elsewhere

Finally, monetary policy tin contribute to offsetting major disturbances inwards the economical organisation arising from other sources....

I receive got position this bespeak last, as well as stated it inwards qualified terms-as referring to major disturbances-because I believe that the potentiality of monetary policy inwards offsetting other forces making for instability is far to a greater extent than express than is ordinarily believed. We merely range non know plenty ... Experience suggests that the path of wisdom is to occupation monetary policy explicitly to offset other disturbances only when they offering a "clear as well as nowadays danger."Friedman's assessment of financial stimulus has a contemporary band equally well:

In the U.S. of A. of America the revival of belief inwards the potency of monetary policy was strengthened also yesteryear increasing disillusionment with financial policy, non so much with its potential to touching aggregate demand equally with the practical as well as political feasibility of so using it. Expenditures turned out to response sluggishly as well as with long lags to attempts to adjust them to the course of written report of economical activity, so emphasis shifted to taxes. But hither political factors entered with a vengeance to forbid prompt adjustment to presumed need, equally has been so graphically illustrated inwards the months since I wrote the initiatory of all draft of this talk. "Fine tuning" is a marvelously evocative phrase inwards this [1968!] electronic age, but it has petty resemblance to what is possible inwards practice.

(Note, my spider web log posts oft evolve equally I correspond with people. This 1 is probable to receive got such a fate.)