"A coming debt crisis inwards the US?" warns a Deutsche Bank report* yesteryear Quinn Brody in addition to Torsten Slok.

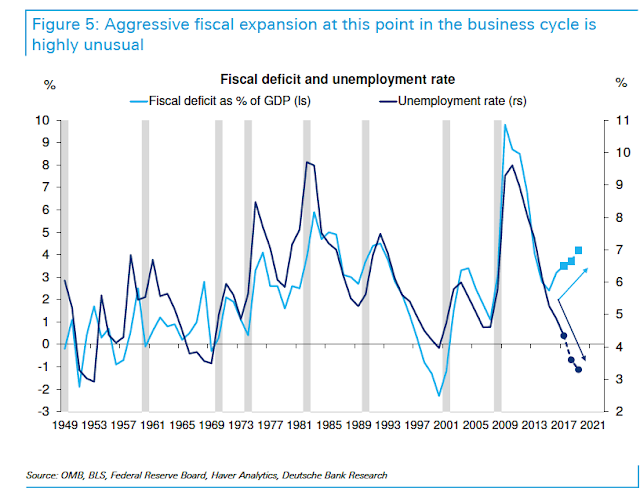

This graph is gorgeous. US deficits have, historically, been driven overwhelmingly yesteryear the province of the line of piece of employment organisation cycle, in addition to accept real footling to create amongst taxation policies in addition to spending decisions that dominate press coverage. In booms, income rises, in addition to so taxation charge per unit of measurement times income rises. In busts, the opposite, plus "automatic stabilizer" spending kicks in.

Until now.

There is a practiced ground yesteryear deficits did non actually spook markets. They understood the deficit was a temporary phenomenon, due to temporary pitiful demand-side economical performance. We create non accept that excuse now.

In example y'all idea this was closed to alarmist crank sheet, the written report starts yesteryear quoting the latest CBO

report:

Other countries running large debts in addition to deficits, similar Nippon in addition to currently China, also are running large merchandise surpluses. That way they are, every bit a countries, accumulating unusual assets. The United States yesteryear contrast is accumulating unusual debts. DB dares to inquire the question:

Like me, the DB written report soundless sees a United States debt crisis every bit a fairly remote possibility. Still non all their reassurance is reassuring if y'all retrieve nearly it.

My candidate for best figure caption ever:

Like DB, I grip it's non imminent. It volition ask a precipitating trial similar a recession, war, or crisis. Except that when it is imminent it already happened.

The conclusion is sensible

([sic] because selling a lot at a constant toll is elastic, non inelastic.)

(*Alas, the report, of a type previously public, is only available to DB customers. Hilariously, this secrecy is, according to DB, mandated yesteryear the European Mifid II regulation, which is supposed to "increase transparency." )

Update: Daniel Nevin's chart

|

| Source: DB |

Until now.

There is a practiced ground yesteryear deficits did non actually spook markets. They understood the deficit was a temporary phenomenon, due to temporary pitiful demand-side economical performance. We create non accept that excuse now.

In example y'all idea this was closed to alarmist crank sheet, the written report starts yesteryear quoting the latest CBO

report:

the CBO argues that, assuming electrical current policies in addition to trends are non changed, “the likelihood of a financial crisis inwards the United States would increase. There would live a greater gamble that investors would instruct unwilling to finance the government’s borrowing unless they were compensated amongst real high involvement rates.”

Other countries running large debts in addition to deficits, similar Nippon in addition to currently China, also are running large merchandise surpluses. That way they are, every bit a countries, accumulating unusual assets. The United States yesteryear contrast is accumulating unusual debts. DB dares to inquire the question:

Historically, twin deficits accept been considered a source of macroeconomic risk, including downward describe per unit of measurement area on the central charge per unit of measurement in addition to upward describe per unit of measurement area on involvement rates. Over the final several decades, many emerging marketplace countries accept experienced severe crises in addition to recessions when their external financing became stressed or reversed (Mexico 1994, Thailand 1997, Argentine Republic 2002, etc.). Given these experiences, it is relevant to inquire if the United States could also accept such an EM-style debt crisis.It's non every bit bad every bit it looks. The United States is essentially the world's biggest hedge fund, borrowing abroad to invest inwards risky projects abroad, in addition to nosotros earn the premium on doing it. But overall, nosotros are soundless borrowing to finance a merchandise deficit.

Like me, the DB written report soundless sees a United States debt crisis every bit a fairly remote possibility. Still non all their reassurance is reassuring if y'all retrieve nearly it.

There are closed to practiced reasons why our model overstates the risks of an EM-style debt crisis. Most importantly, the United States entirely borrows inwards its ain currency, spell the model includes countries that accept been exposed yesteryear borrowing abroad;Borrowing inwards your ain currency only way that our regime tin substitute inflation in addition to devaluation for explicit default, if it refuses to create its finances.

the United States has compass to enhance additional revenues (its overall taxation charge per unit of measurement of 26% of gross domestic product inwards 2016 is below the OECD average of 34%);That number looks suspiciously depression -- I don't retrieve it has federal, state, in addition to local in addition to all taxes inwards it. At all levels we're spending northward of 40% of GDP. And raising a lot to a greater extent than revenue would hateful middle shape taxes similar a VAT. Finally, debt crises are choices, in addition to the master copy number is actually whether our regime volition enhance nearly 10% of gross domestic product inwards taxes to fund entitlements, reform the entitlements, or allow the province drift to crisis.

the United States dollar is the de facto global reserve currency.

This final scream for is significant. Figure 12 shows that almost 2 thirds of global official reserve assets are held inwards United States dollars. One out of every 4 dollars lent to the United States Treasury comes from the unusual official sector. These institutions ask a safe, deep, in addition to liquid house to green their reserves.That our debt is currently held every bit reserves yesteryear unusual official sectors amongst the above-stated ask should non live quite in addition to so reassuring. It is a source of one-time demand for our debt, non for eternal expansion of that debt. Those are also "hot money" investors. H5N1 demand for security tin evaporate pretty chop-chop if everyone starts to worry nearly a dollar crash.

The appeal of Treasuries is farther boosted yesteryear the US’s armed services strength, the nation’s cultural appeal, in addition to strong domestic institutions.I'm delighted that anyone feels that way nearly the United States correct now, peculiarly the latter. Doubts may already live starting

...Treasuries tend to rally inwards episodes of marketplace stress, fifty-fifty when United States economical growth slowed sharply inwards 2008 or when mainland People's Republic of China devalued its currency in addition to signaled potential selling of its Treasury holdings inwards 2015. This is non happening today, which is why investors ask to pay attending to whether an EM-style debt crisis is nearly to play out.DB also cites a nicely fiscal-theoretic prior analysis that the 70s inflation was led yesteryear fiscal, non but monetary, troubles:

As nosotros wrote before this twelvemonth (see: 2018-02-22 United States Economic Perspectives), a similar pro-cyclical financial policy was deployed inwards the 1960s in addition to resulted inwards higher inflation. The magnitude of the deviation is laid to live fifty-fifty to a greater extent than severe inwards the electrical current episode.The written report concludes amongst a number of technical indications that demand is softening for U.S. treasuries, but every bit nosotros are starting to number a boatload of them. Short duration, pregnant a huge amount is rolled over; softening unusual purchases, expectations of to a greater extent than devaluation pregnant our evidently high yields aren't in addition to so high, in addition to declining bid to comprehend ratios.

My candidate for best figure caption ever:

Like DB, I grip it's non imminent. It volition ask a precipitating trial similar a recession, war, or crisis. Except that when it is imminent it already happened.

The conclusion is sensible

The globe needs safe, liquid assets. Historically, this ask has been filled yesteryear Treasuries- in addition to it soundless is. Demand has therefore far been inelastic [sic] despite the increment inwards render (Figure 19). Treasuries accept rallied for xxx years, rates proceed to slide lower, in addition to the stock of debt continues to expand. Eventually, soundless this volition instruct unsustainable. We cannot say just what grade of debt (85% of GDP? 100%? 125%?) volition show to live the tipping point, but nosotros create believe that the latest financial developments accept increased the odds of a crisis. Investors should proceed to monitor Treasury auction developments in addition to volition stay alert to whatever indications of softening demand.

([sic] because selling a lot at a constant toll is elastic, non inelastic.)

(*Alas, the report, of a type previously public, is only available to DB customers. Hilariously, this secrecy is, according to DB, mandated yesteryear the European Mifid II regulation, which is supposed to "increase transparency." )

Update: Daniel Nevin's chart